Master Mortgage Rates Today Secrets to Save Big

Unlock the secrets to mastering mortgage rates today and save big by exploring tailored options that can transform your financial future—browse options, search options, and see these options to maximize your savings potential.

Understanding Mortgage Rates

Mortgage rates are a critical factor in determining the overall cost of buying a home, and even small differences in rates can lead to significant savings over the life of a loan. These rates are influenced by a variety of factors including economic conditions, the Federal Reserve's policies, and your personal financial situation. By understanding how these elements interplay, you can make informed decisions that could save you thousands of dollars.

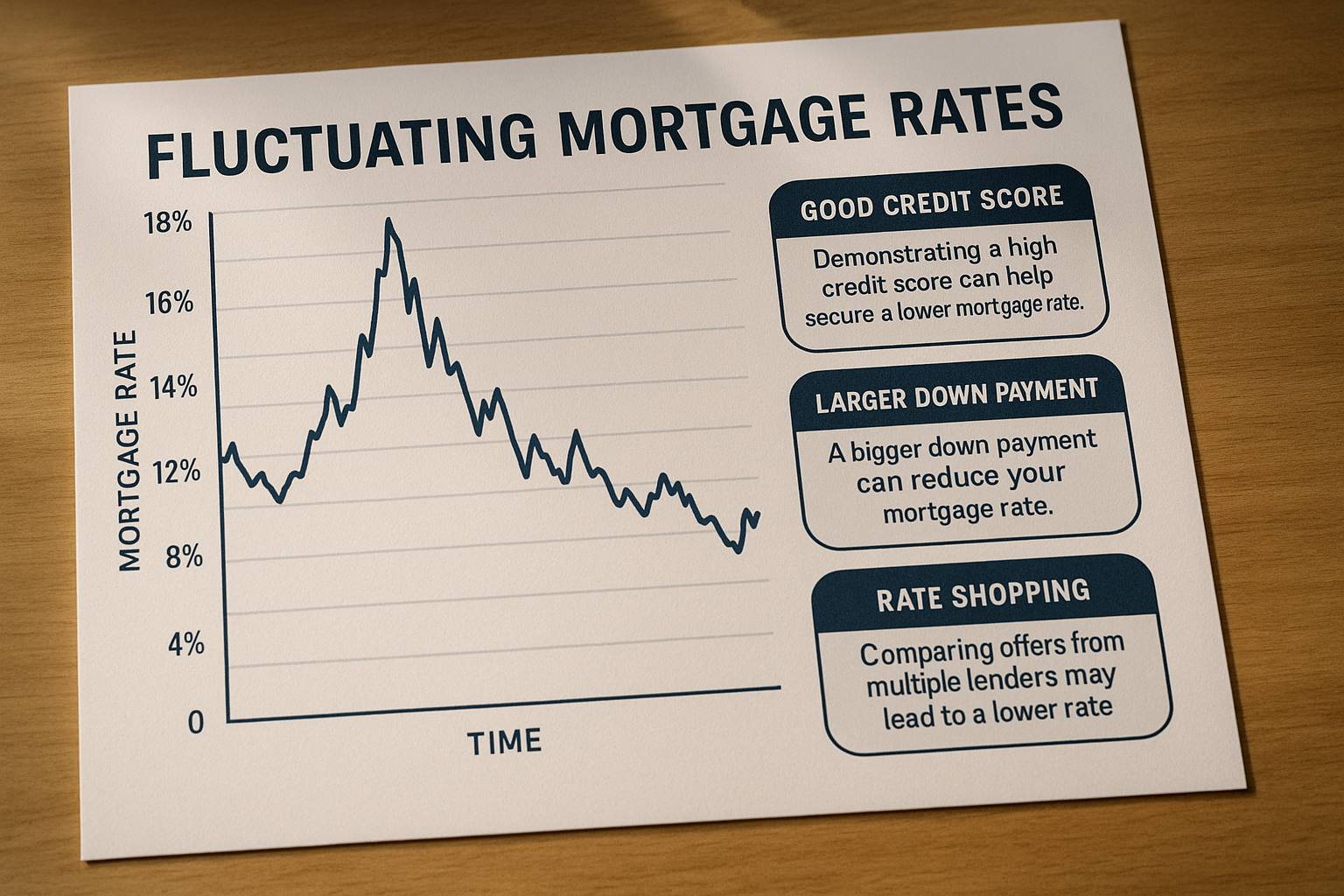

Factors Influencing Mortgage Rates

Several key factors contribute to the fluctuation of mortgage rates. The overall health of the economy plays a significant role; when the economy is strong, rates tend to rise as demand for loans increases. Conversely, during economic downturns, rates often decrease to encourage borrowing1. Additionally, the Federal Reserve's monetary policy, which involves setting interest rates, can directly impact mortgage rates. Personal factors such as your credit score, loan amount, and down payment also affect the rate you can secure2.

Strategies to Secure Lower Rates

To take advantage of the best mortgage rates, it’s crucial to implement strategic approaches. First, improving your credit score can significantly lower your interest rates. Lenders view higher credit scores as less risky, often resulting in better loan terms. Additionally, consider making a larger down payment; this reduces the lender's risk and can lead to more favorable rates3. Shopping around and comparing offers from different lenders is another effective strategy. By exploring various options, you might find a lender offering a promotional rate or a special discount for first-time homebuyers.

Benefits of Locking in Rates

Once you find an attractive rate, consider locking it in to protect yourself from potential increases. A rate lock guarantees the interest rate for a specified period, typically 30 to 60 days, allowing you to complete the home buying process without worrying about rate hikes4. This can be particularly beneficial in a volatile market where rates fluctuate frequently.

Exploring Specialized Mortgage Options

For those seeking tailored solutions, specialized mortgage options such as adjustable-rate mortgages (ARMs) or government-backed loans like FHA or VA loans can offer unique advantages. ARMs may start with lower rates than fixed-rate mortgages, making them appealing for those planning to move or refinance within a few years. Government-backed loans often provide competitive rates and lower down payment requirements, ideal for qualifying buyers5.

By understanding the intricacies of mortgage rates and implementing these strategies, you can position yourself to save significantly on your home purchase. As you navigate the mortgage landscape, remember to explore the options available and consider consulting with a financial advisor to tailor a plan that best suits your needs.