Secure Top Deals With Elite Real Estate Mortgage Lenders

Secure the best deals in real estate by exploring elite mortgage lender options that can unlock substantial savings and benefits tailored to your financial goals.

Understanding Elite Real Estate Mortgage Lenders

Navigating the real estate market can be daunting, but partnering with elite mortgage lenders can significantly ease the process and maximize your investment returns. These lenders offer competitive interest rates, personalized loan packages, and exceptional customer service, which can make a substantial difference in your financial journey. By choosing the right lender, you not only secure a favorable mortgage but also benefit from expert advice and tailored solutions that align with your specific needs.

Benefits of Choosing Elite Lenders

One of the primary advantages of working with top-tier mortgage lenders is access to competitive interest rates. These lenders often have the flexibility to offer lower rates due to their established relationships with financial institutions and their ability to assess risk more effectively. This can translate into significant savings over the life of your loan. Additionally, elite lenders provide customized loan products that cater to various financial situations, whether you're a first-time homebuyer or seeking to refinance an existing mortgage.

Moreover, elite lenders are known for their superior customer service. They guide you through every step of the mortgage process, ensuring a smooth and transparent experience. Their expertise can help you navigate complex financial decisions, making them invaluable partners in your real estate endeavors.

Real-World Data and Statistics

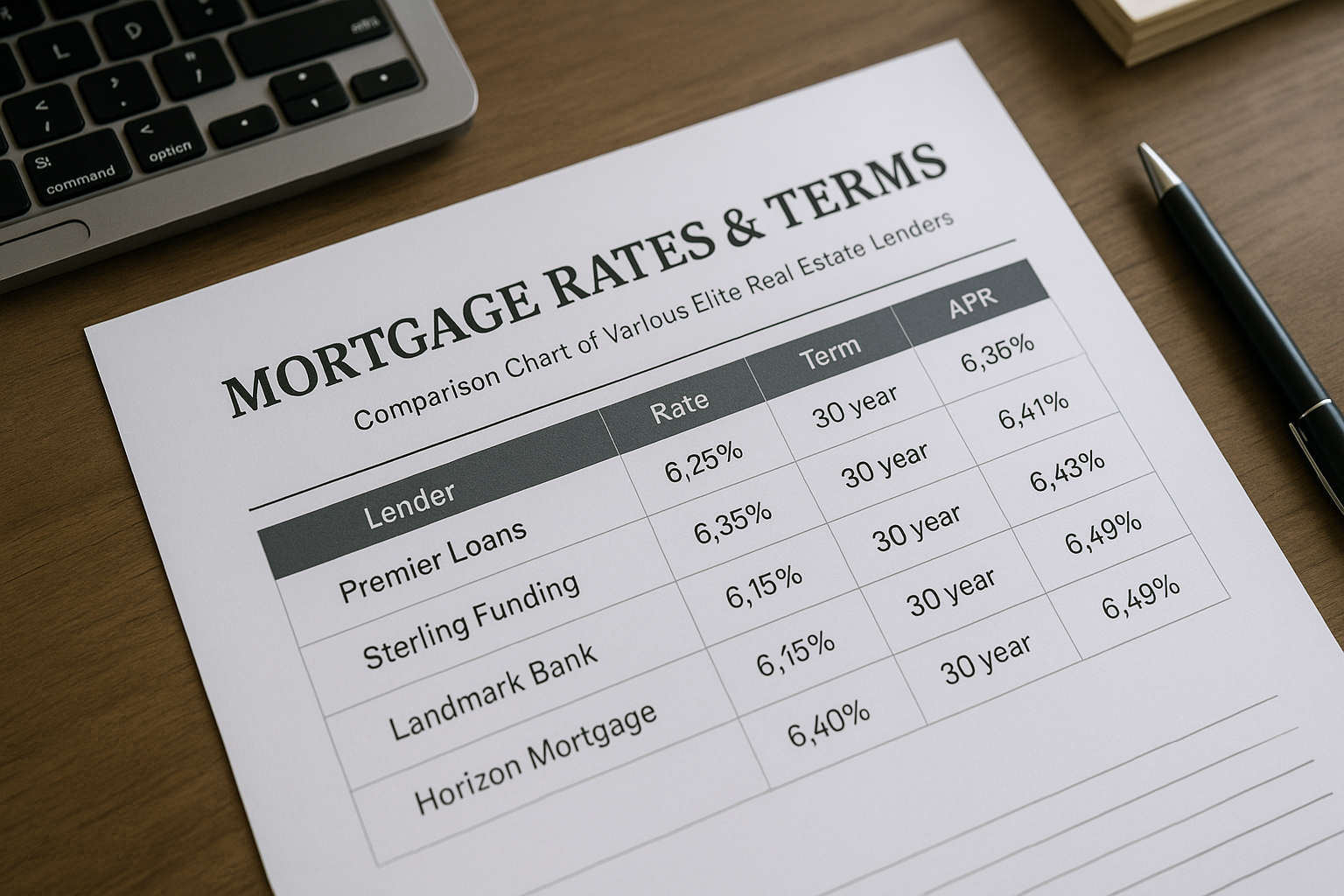

According to recent data, borrowers who work with elite mortgage lenders can save an average of 0.25% to 0.50% on their interest rates compared to standard lenders1. This may not seem like much at first glance, but over a 30-year loan term, these savings can amount to tens of thousands of dollars. Furthermore, a study by the Consumer Financial Protection Bureau found that borrowers who shop around and consider multiple lender options are more likely to find better deals and terms2.

Types of Mortgage Products Available

Elite lenders offer a variety of mortgage products to suit different financial needs. These include fixed-rate mortgages, which provide stability with a constant interest rate over the loan term, and adjustable-rate mortgages (ARMs), which can offer lower initial rates and potential savings if you plan to sell or refinance before the rate adjusts. Additionally, there are specialized loan products such as jumbo loans for high-value properties and FHA loans for buyers with lower credit scores or smaller down payments.

How to Choose the Right Lender

Selecting the right mortgage lender involves more than just comparing interest rates. It's essential to consider the lender's reputation, customer service, and the range of products they offer. Start by researching online and reading reviews from other borrowers. It's also beneficial to schedule consultations with multiple lenders to discuss your financial situation and explore the options available to you. By doing so, you can ensure that you make an informed decision that aligns with your long-term financial goals.

Exploring Additional Resources

For those interested in diving deeper into the world of elite mortgage lending, there are numerous resources available online. Websites like Bankrate and NerdWallet offer comprehensive comparisons of different lenders and provide tools to calculate potential savings. Additionally, visiting the websites of specific lenders can give you an insight into their offerings and help you make an informed choice.

Securing a mortgage with an elite lender can be a game-changer in your real estate journey. By taking the time to explore your options and understand the benefits each lender offers, you can ensure that you make the most of your investment and enjoy the financial rewards that come with it.