Secret Strategy Saves Money and Doubles Your Savings

Unlock the secret strategy that not only saves you money but also doubles your savings, providing you with the financial freedom to explore more options, visit websites, and browse opportunities that can transform your financial future.

Understanding the Secret Strategy

In today's fast-paced world, managing finances efficiently is crucial to achieving long-term financial goals. The secret strategy involves a combination of disciplined saving, strategic investing, and leveraging technology to maximize your savings potential. By adopting this approach, you can significantly enhance your financial stability and growth.

The Power of Automated Savings

Automated savings is a cornerstone of this strategy. By setting up automatic transfers from your checking account to a dedicated savings account, you ensure consistent growth of your savings without the temptation to spend. Many banks offer features that allow you to round up purchases to the nearest dollar and deposit the difference into your savings account, effectively doubling your savings over time without noticeable impact on your daily budget1.

Investing in High-Yield Accounts

To double your savings, consider investing in high-yield savings accounts or certificates of deposit (CDs). These financial products offer higher interest rates compared to traditional savings accounts, allowing your money to grow faster. For instance, some high-yield savings accounts currently offer interest rates above 4% annually2. By exploring these options, you can significantly increase your savings over time.

Leveraging Technology for Financial Management

Utilizing financial apps and tools can provide valuable insights into your spending habits and help you identify areas where you can cut costs. Apps like Mint and YNAB (You Need A Budget) offer features that track expenses, set budgets, and suggest saving strategies tailored to your financial situation3. By integrating these tools into your routine, you can make informed decisions that enhance your savings potential.

Exploring Investment Opportunities

Beyond traditional savings, investing in stocks, bonds, or mutual funds can offer substantial returns. The key is to diversify your investments to mitigate risks and maximize gains. Historically, the stock market has provided an average annual return of about 7% after inflation4. By researching and selecting the right investment options, you can effectively double your savings over time.

Reducing Unnecessary Expenses

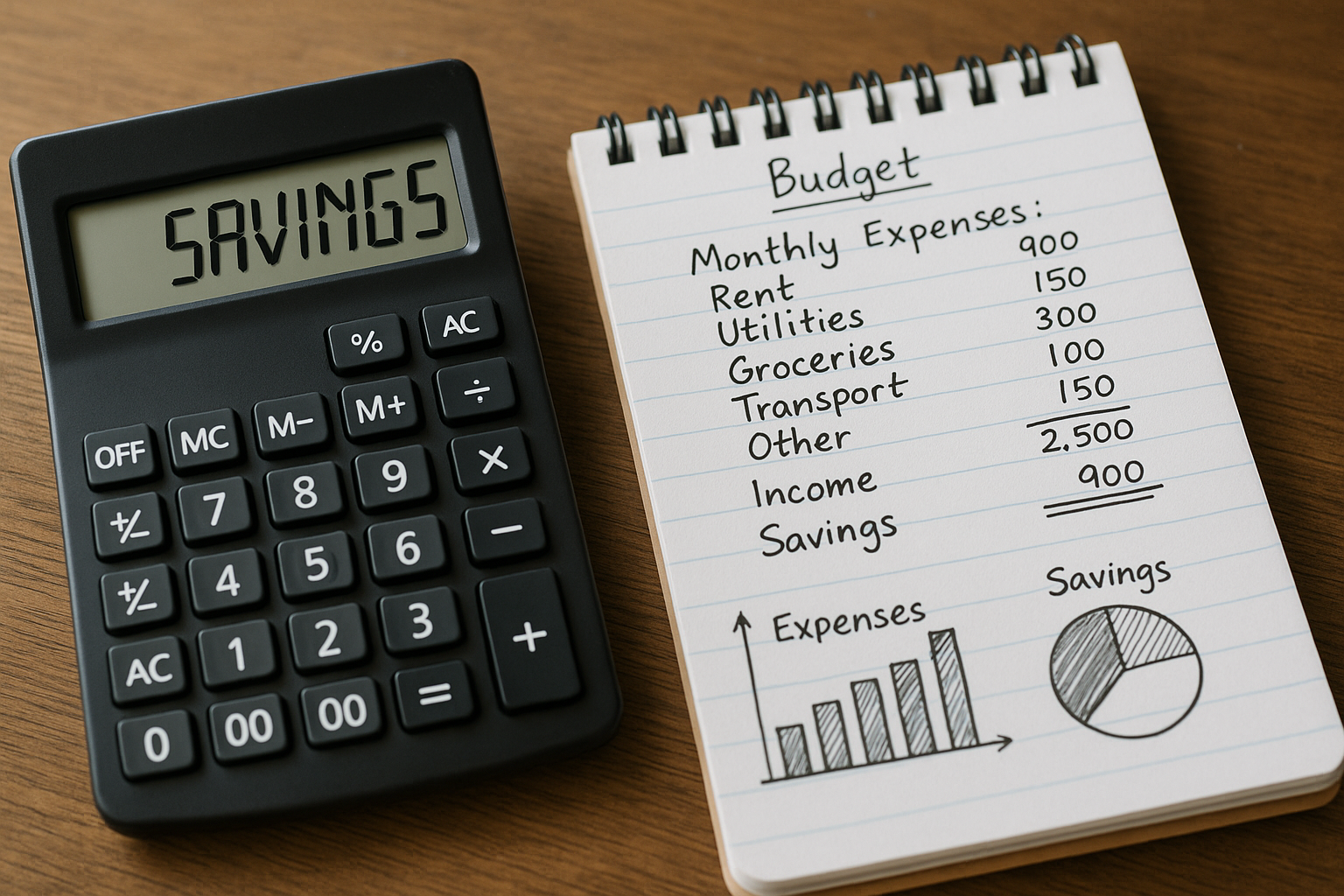

A critical component of this strategy is cutting down on unnecessary expenses. Reviewing your monthly subscriptions, dining habits, and utility bills can uncover potential savings. Many services offer discounts for annual subscriptions or bundled packages, which can lead to significant savings. Additionally, implementing energy-saving practices at home can reduce utility costs, freeing up more funds for your savings goals.

Incorporating these elements into your financial plan not only saves you money but also positions you to double your savings over time. By taking proactive steps and exploring the available resources, you can achieve financial security and the freedom to pursue the opportunities that matter most to you.