Easily Slash Your Closing Costs Using Home Equity

If you're looking to significantly reduce your closing costs when buying or refinancing a home, leveraging home equity could be your key to savings—so browse options, visit websites, and see these options to discover how you can make the most of your investment.

Understanding Home Equity and Its Role in Closing Costs

Home equity is essentially the portion of your home that you truly own, calculated by subtracting any remaining mortgage balance from the market value of your property. This financial resource can be a powerful tool when it comes to slashing your closing costs. By utilizing home equity, you may be able to negotiate better terms on your mortgage, potentially reducing lender fees or even eliminating certain costs altogether.

How Home Equity Can Reduce Closing Costs

One of the primary ways to use home equity to reduce closing costs is through a home equity line of credit (HELOC) or a home equity loan. These financial products can provide you with the liquidity needed to cover closing costs without tapping into your savings. By strategically using these options, you can negotiate with lenders to lower fees or even roll closing costs into your loan amount, thus spreading the cost over the life of the loan rather than paying upfront.

Additionally, some lenders offer reduced closing costs as part of a home equity loan package. It's worth researching and comparing different lenders to find those that offer competitive terms. For instance, some banks may offer promotional rates or waive certain fees if you open a new home equity line of credit with them1.

Steps to Leverage Home Equity for Lower Closing Costs

- Evaluate Your Home Equity: Start by assessing your current home equity. This involves getting a professional appraisal to determine your home's current market value and subtracting your outstanding mortgage balance.

- Research Lenders: Not all lenders offer the same terms, so it's crucial to shop around. Look for lenders who provide favorable terms on home equity loans or HELOCs, and who might offer reduced closing costs as part of their package.

- Negotiate Terms: Use your home equity as leverage in negotiations. A strong equity position can often result in more favorable loan terms, such as lower interest rates or reduced fees.

- Consider Loan Options: Depending on your financial situation, you might consider a cash-out refinance, which allows you to refinance your mortgage for more than you owe and take the difference in cash, which can be used to cover closing costs2.

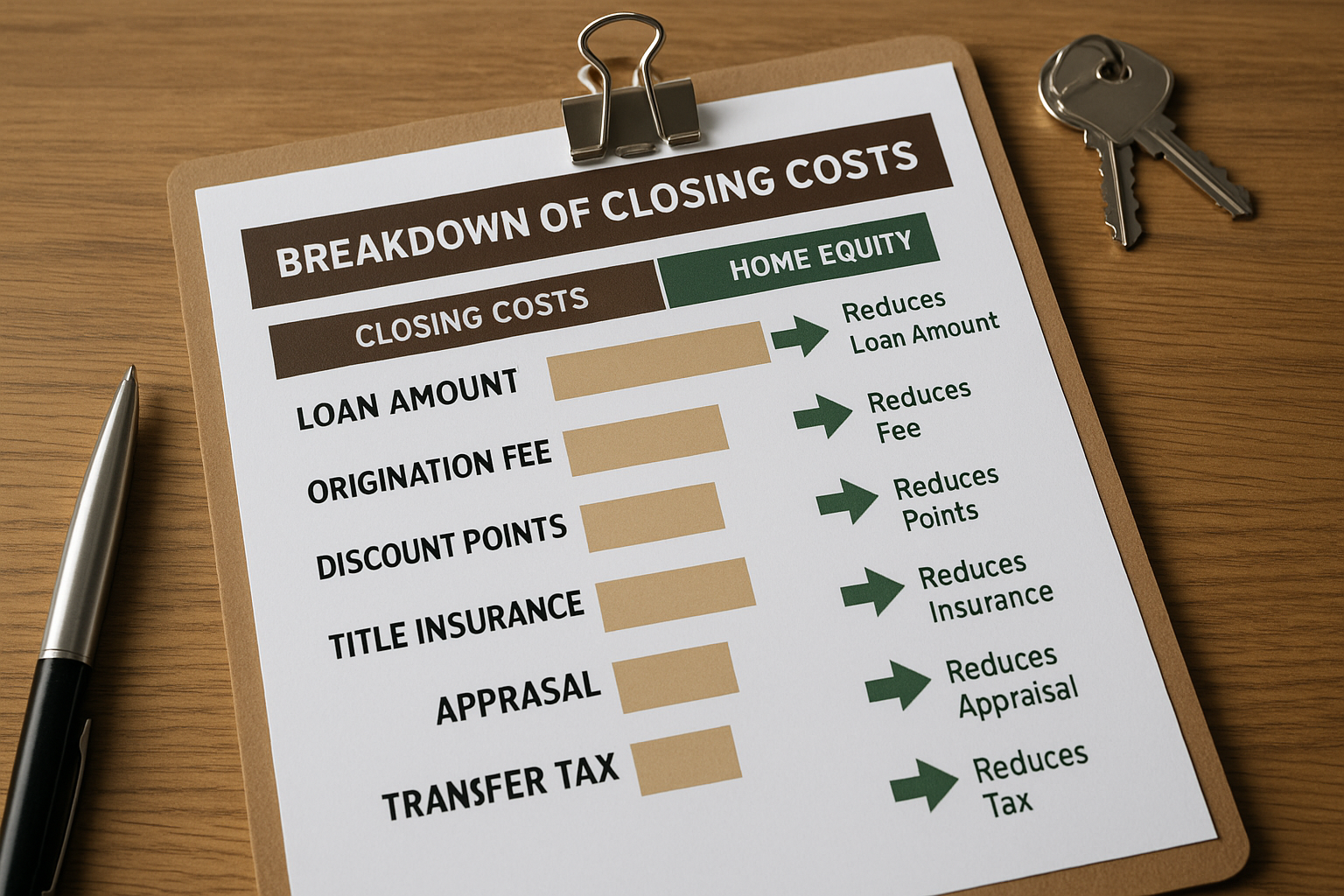

Understanding the Costs Involved

Closing costs typically range from 2% to 5% of the loan amount3. These costs can include appraisal fees, title insurance, attorney fees, and more. By using home equity, you can potentially save thousands of dollars in upfront costs. For example, if you're purchasing a $300,000 home, closing costs could range from $6,000 to $15,000. Leveraging your home equity to cover these costs can significantly ease the financial burden.

Potential Risks and Considerations

While using home equity to reduce closing costs can be advantageous, it's important to consider the potential risks. Increasing your mortgage balance or taking out a HELOC can lead to higher monthly payments or extended loan terms. It's crucial to evaluate your long-term financial goals and ensure that the benefits outweigh the costs.

Final Insights

By strategically using your home equity, you can effectively reduce your closing costs, making home buying or refinancing more affordable. It's essential to explore all available options, research lenders, and negotiate terms that align with your financial objectives. With the right approach, you can maximize your savings and make a sound investment in your future.