Master Real Estate Expressions Transform Property Deals Forever

Unlocking the power of real estate expressions can transform your property deals, offering you unparalleled insights and opportunities to browse options and make informed decisions that maximize your investments.

Understanding Real Estate Expressions

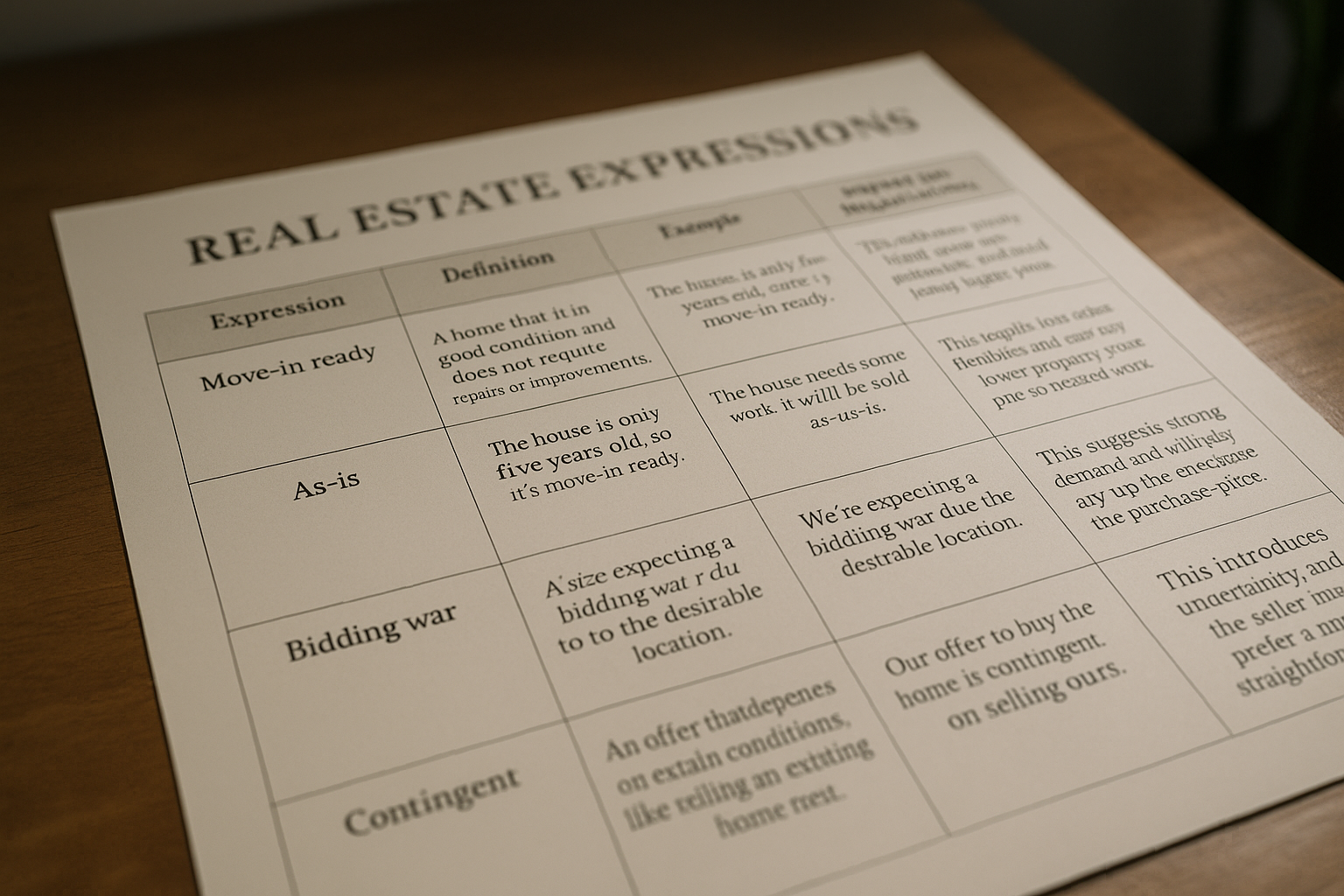

Real estate expressions are specialized terms and phrases that convey specific meanings in property transactions. Mastering these can significantly impact your ability to negotiate and close deals effectively. Whether you're a seasoned investor or new to the market, understanding these expressions can help you navigate complex deals and identify lucrative opportunities.

Key Expressions to Know

In real estate, certain expressions are crucial for interpreting market trends and property values. Terms like "cap rate," "cash flow," and "equity" are fundamental to evaluating investment properties. The cap rate, or capitalization rate, is a key metric used to estimate the return on investment of a property. It is calculated by dividing the property's net operating income by its purchase price. A higher cap rate indicates a potentially higher return, which is essential when searching for profitable investments1.

Enhancing Negotiation Skills

Negotiation is an art, and mastering real estate expressions can give you a competitive edge. Phrases such as "contingency clause," "earnest money," and "due diligence" play critical roles in contract negotiations. A contingency clause allows buyers to back out of a deal under certain conditions without losing their deposit, while earnest money is a deposit made to demonstrate a buyer's serious intent. Understanding these terms can help you structure deals that protect your interests while remaining attractive to sellers2.

Leveraging Market Insights

Real estate expressions also provide insights into market conditions. Terms like "seller's market" and "buyer's market" describe the balance of supply and demand in the market. In a seller's market, demand exceeds supply, often leading to higher prices and competitive bidding. Conversely, a buyer's market indicates more properties than buyers, providing opportunities to negotiate better deals3. By understanding these dynamics, you can time your investments to maximize returns.

Real-World Applications

Consider the example of a real estate investor who effectively uses expressions to identify a property with a high cap rate in a buyer's market. By negotiating favorable terms through a well-structured contingency clause, the investor can secure a property at a lower price with minimal risk. This strategic approach can lead to significant financial gains and long-term wealth building.

Exploring Further Resources

For those eager to dive deeper into the world of real estate expressions, numerous resources are available. Websites offering in-depth guides and courses can enhance your understanding and application of these terms. By visiting websites and exploring specialized options, you can gain the knowledge necessary to excel in real estate investing and negotiation.

Mastering real estate expressions is more than just learning terminology; it's about unlocking opportunities and maximizing your investment potential. As you continue to explore these options, you'll find yourself better equipped to navigate the complexities of the real estate market and achieve your financial goals.