Turn One House Into Two Effortless Home Investments

Transforming a single property into two lucrative investments can significantly boost your real estate portfolio, and by exploring options like property splitting, you can unlock hidden value and maximize returns.

Understanding the Concept of Turning One House Into Two Investments

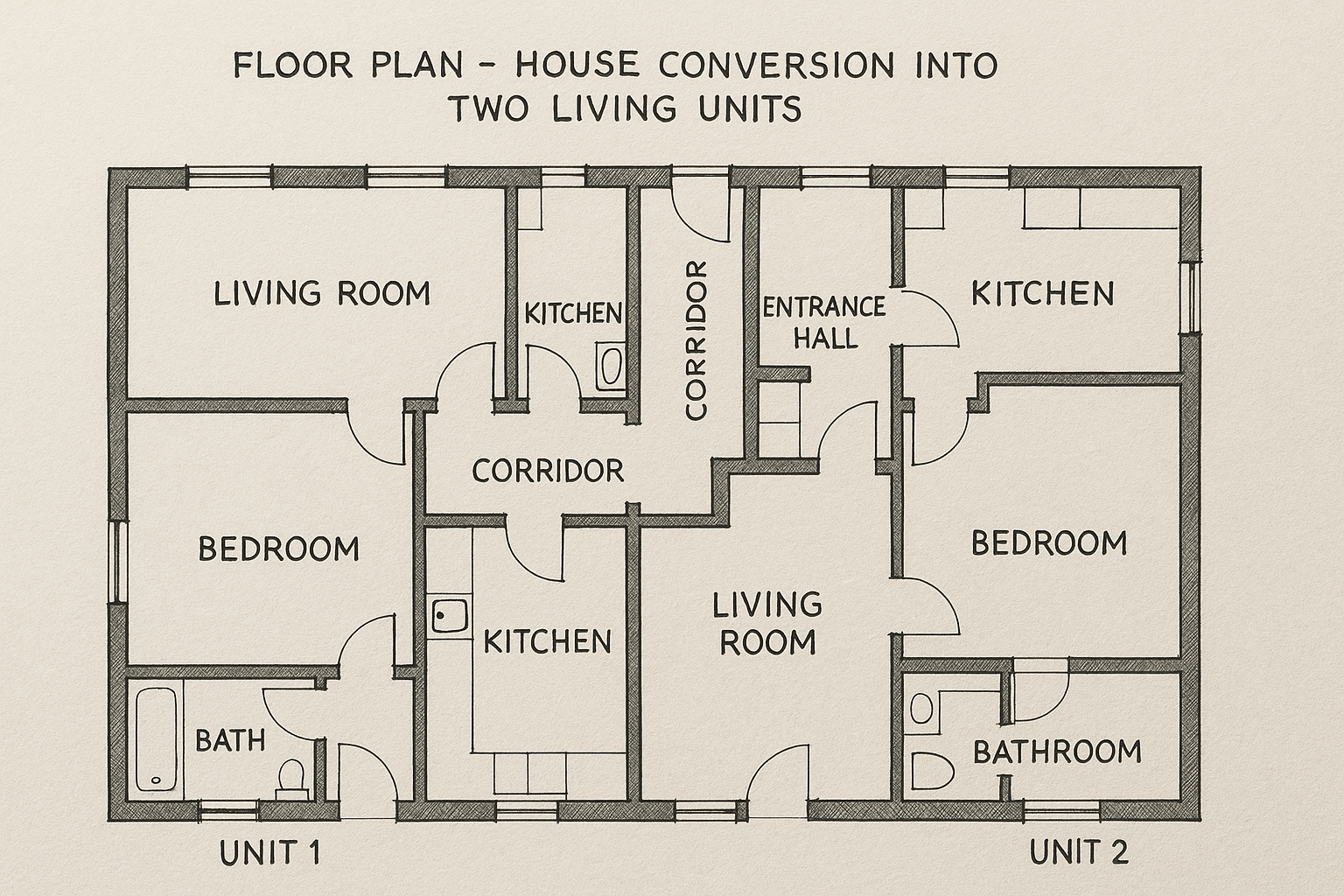

The idea of turning one house into two investments is rooted in the concept of property splitting, which involves dividing a single property into two separate units. This strategy can increase rental income, enhance property value, and provide tax benefits. By converting a single-family home into a duplex or adding an accessory dwelling unit (ADU), homeowners can capitalize on their existing assets.

Benefits of Property Splitting

One of the primary benefits of property splitting is the potential for increased rental income. By creating two units from one, you can rent out both spaces, effectively doubling your rental revenue. This approach is particularly appealing in high-demand rental markets where housing shortages drive up rental prices. Moreover, having two units can provide a buffer against vacancy risks, as it's less likely that both units will be vacant simultaneously.

Additionally, property splitting can significantly enhance the overall value of your property. Properties with multiple units often appraise higher due to their income-generating potential. This increase in value can be a substantial advantage if you decide to sell the property in the future.

Cost Considerations and Financial Implications

While the benefits are enticing, it's essential to consider the costs involved in property splitting. Renovation expenses can vary widely depending on the extent of the modifications required. For instance, converting a basement into a separate unit might cost between $50,000 and $75,0001. However, these costs can often be offset by the increased rental income and property value.

Financing options are available to support these renovations. Home equity loans or lines of credit are popular choices, allowing homeowners to leverage their property's existing value to fund the project. Additionally, some municipalities offer grants or incentives for creating additional housing units, so it's worth researching these opportunities in your area.

Legal and Zoning Considerations

Before embarking on a property-splitting project, it's crucial to understand local zoning laws and regulations. Zoning laws dictate what types of structures can be built and how properties can be used. Some areas have restrictions on converting single-family homes into multi-unit properties. It's essential to consult with a real estate attorney or zoning expert to ensure compliance with local regulations.

Furthermore, obtaining the necessary permits is a critical step in the process. Permits ensure that the construction meets safety standards and adheres to building codes. Failing to secure the appropriate permits can result in fines or legal complications.

Real-World Examples and Success Stories

Many homeowners have successfully increased their wealth through property splitting. For example, in cities like Los Angeles and Seattle, where housing demand is high, converting a garage into an ADU has become a popular investment strategy. These units can generate significant rental income, often covering the cost of the conversion within a few years2.

In Portland, Oregon, a homeowner converted their single-family home into a triplex, significantly increasing their rental income while also benefiting from tax incentives for creating additional housing units3.

Exploring Further Opportunities

If you're considering property splitting as a strategy, it's beneficial to browse options and visit websites that offer guidance on financing, zoning laws, and construction services. Real estate investment forums and local government websites can provide valuable insights and resources to help you navigate the process.

By following the options available and staying informed about market trends and legal requirements, you can transform a single property into a dual-income powerhouse.