Achieve Prosperity Fast with Insider Multifamily Loan Secrets

If you're eager to unlock the secrets of multifamily loans and achieve prosperity fast, seize this opportunity to browse options and discover valuable insights that can transform your financial future.

Understanding Multifamily Loans

Multifamily loans are a powerful tool for investors looking to expand their real estate portfolios quickly. These loans are specifically designed to finance properties with multiple units, such as apartment buildings, duplexes, or townhouses. The appeal of multifamily loans lies in their ability to generate steady income streams, diversify investment risks, and offer significant tax benefits. By understanding the nuances of these loans, you can leverage them to maximize your investment returns.

Types of Multifamily Loans

There are several types of multifamily loans available, each catering to different investor needs and property sizes. The most common types include:

- Conventional Multifamily Loans: Offered by banks and financial institutions, these loans typically require a down payment of 20-30% and are best suited for investors with strong credit histories.

- FHA Multifamily Loans: Insured by the Federal Housing Administration, these loans are ideal for first-time investors as they offer lower down payments and more flexible credit requirements.

- Freddie Mac and Fannie Mae Loans: These government-sponsored enterprises provide competitive rates and terms for multifamily properties, making them popular among seasoned investors.

- Portfolio Loans: Tailored for investors with unique needs, portfolio loans are held by the lender and offer more flexibility in terms of underwriting and property types.

Benefits of Multifamily Loans

Investing in multifamily properties through specialized loans offers numerous benefits:

- Higher Income Potential: With multiple units, you can generate more rental income compared to single-family properties.

- Economies of Scale: Managing several units under one roof reduces costs per unit, increasing your overall profitability.

- Risk Diversification: With multiple tenants, the risk of vacancy is spread out, ensuring more stable cash flows.

- Tax Advantages: Multifamily properties offer various tax deductions, including depreciation and mortgage interest.

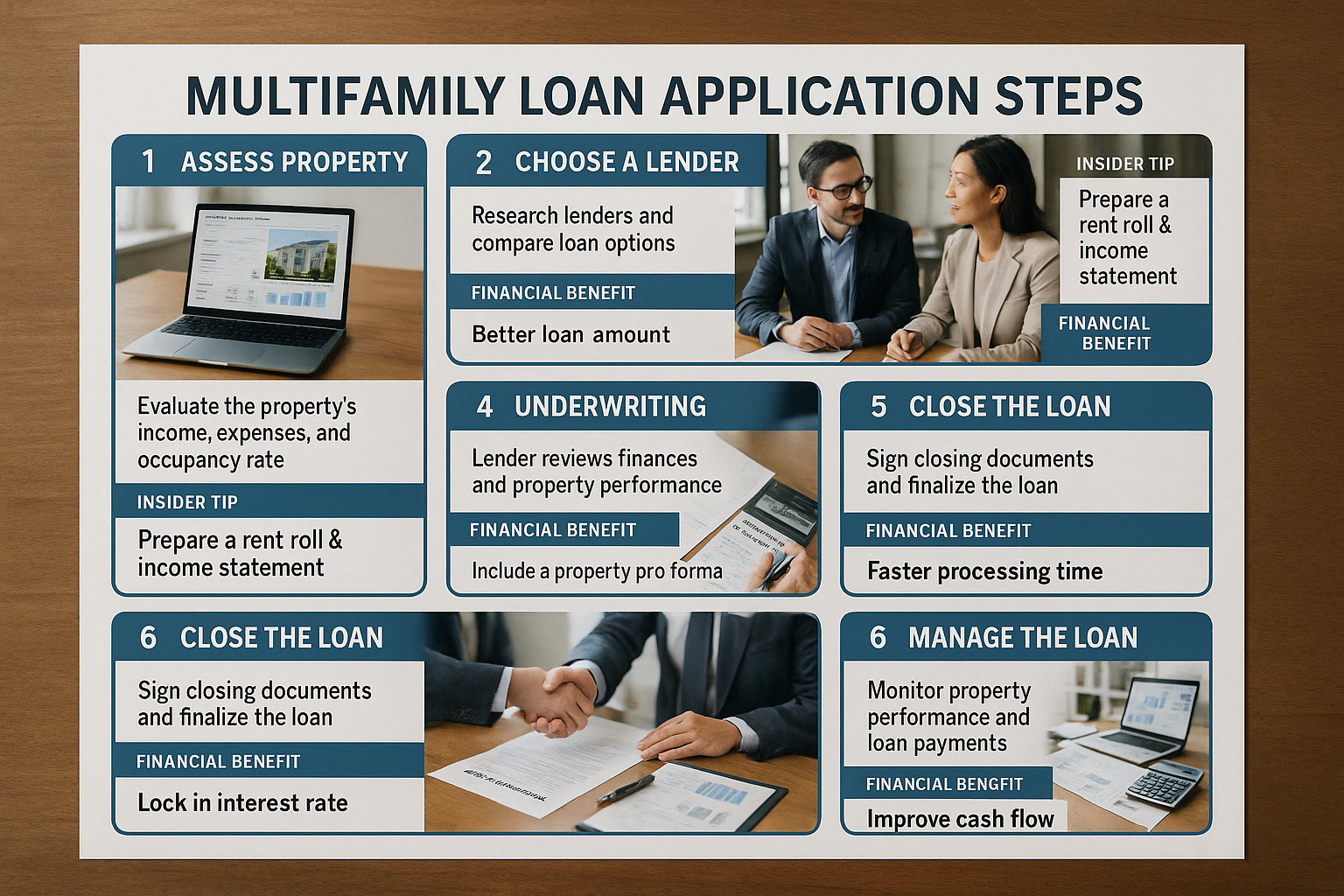

Insider Secrets to Securing Multifamily Loans

Achieving prosperity through multifamily loans requires strategic planning and insider knowledge. Here are some tips to help you secure the best deals:

Real-World Examples and Financial Context

The multifamily loan market has seen significant growth, with the Mortgage Bankers Association reporting that commercial and multifamily mortgage debt outstanding increased by $70 billion in the second quarter of 20231. This growth highlights the increasing demand for multifamily investments, driven by urbanization trends and housing shortages.

Interest rates for multifamily loans typically range from 3% to 5%, depending on the loan type and borrower profile2. Additionally, many lenders offer incentives such as reduced closing costs or rate discounts for borrowers who meet specific criteria, making it worthwhile to explore various options.

Exploring Further Opportunities

As you delve into the world of multifamily loans, remember that numerous resources and specialized services are available to guide you. Whether you're a first-time investor or a seasoned professional, following the options and visiting websites dedicated to multifamily financing can provide you with tailored solutions and expert advice.

By understanding the intricacies of multifamily loans and leveraging insider knowledge, you can position yourself for financial success and prosperity. Take the time to research, plan, and execute your investment strategy, and you'll be well on your way to achieving your financial goals.