Ambulatory Surgery Center Malpractice Insurance Reveals Hidden Savings

If you're seeking to uncover hidden savings in your Ambulatory Surgery Center malpractice insurance, it's time to visit websites and browse options that reveal the financial benefits waiting for you.

Understanding Ambulatory Surgery Center Malpractice Insurance

Malpractice insurance is a critical component for any healthcare facility, including Ambulatory Surgery Centers (ASCs). This specialized insurance protects against claims of negligence, ensuring that both the center and its practitioners are shielded from potentially devastating financial consequences. With the rise in outpatient procedures, ASCs have become a vital part of the healthcare system, making robust malpractice coverage more essential than ever.

Why Malpractice Insurance Matters for ASCs

The very nature of ASCs, which focus on same-day surgical care, means they operate in a high-stakes environment. Any mishap, no matter how minor, can lead to significant legal challenges. Malpractice insurance provides a safety net, covering legal fees, settlements, and other related costs. This protection not only safeguards the financial health of the center but also helps maintain its reputation in a competitive market.

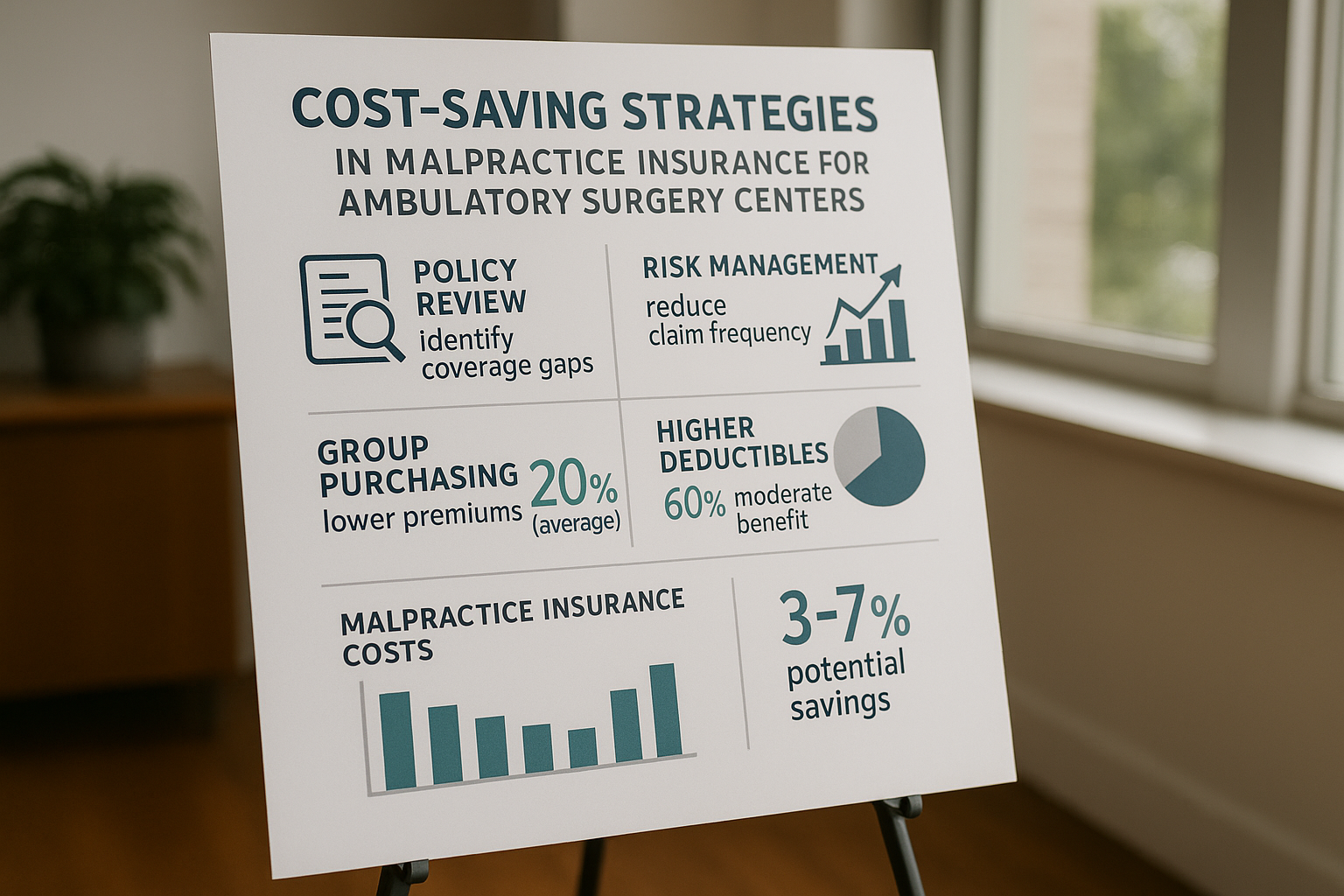

Exploring Hidden Savings

Many ASCs are unaware of the potential savings they can achieve by optimizing their malpractice insurance policies. By conducting a thorough review of current coverage, centers can identify overlaps, gaps, or unnecessary coverage that may lead to cost reductions. Additionally, some insurers offer discounts for ASCs that implement risk management programs or achieve certain accreditation standards, which can further lower premiums.

Key Strategies for Cost Reduction

1. **Risk Assessment and Management**: Regularly conducting risk assessments can help identify areas for improvement. Implementing comprehensive risk management strategies not only enhances patient safety but can also make ASCs eligible for premium discounts1.

2. **Policy Review and Comparison**: It's crucial for ASCs to periodically review their insurance policies and compare them with other available options. This ensures that the center is receiving the best possible rates and coverage2.

3. **Accreditation and Certification**: Pursuing accreditation from recognized bodies such as the Accreditation Association for Ambulatory Health Care (AAAHC) can lead to lower insurance premiums. Accredited centers are often perceived as lower risk by insurers3.

Real-World Examples

Consider the case of an ASC in Florida that managed to cut its malpractice insurance costs by 15% by implementing an electronic health records system and achieving AAAHC accreditation. This not only improved their operational efficiency but also made them eligible for significant insurance discounts4.

The Financial Impact of Optimized Insurance

By strategically managing their malpractice insurance, ASCs can redirect savings towards enhancing patient care, investing in new technologies, or expanding their services. This not only boosts the center's financial health but also its competitive edge in the healthcare market.

Next Steps for ASCs

To fully leverage these savings opportunities, ASCs should engage with insurance brokers who specialize in healthcare coverage, utilize online resources to compare policies, and explore options for risk management training. By staying informed and proactive, ASCs can ensure they are maximizing their savings potential.

References

By exploring these options and implementing strategic changes, ASCs can not only secure substantial savings but also enhance their operational efficiency and service quality.