Compare Home Equity Loan Rates Lower Monthly Payments

When you compare home equity loan rates, you can unlock the potential for lower monthly payments and greater financial flexibility, so browse options to find the best fit for your needs today.

Understanding Home Equity Loans

Home equity loans are a popular financial tool for homeowners looking to leverage the value of their property. Essentially, these loans allow you to borrow against the equity you've built up in your home, offering a lump sum that can be used for various purposes like home improvements, debt consolidation, or other large expenses. The interest rates on home equity loans tend to be lower than those of credit cards or personal loans because they are secured by your property.

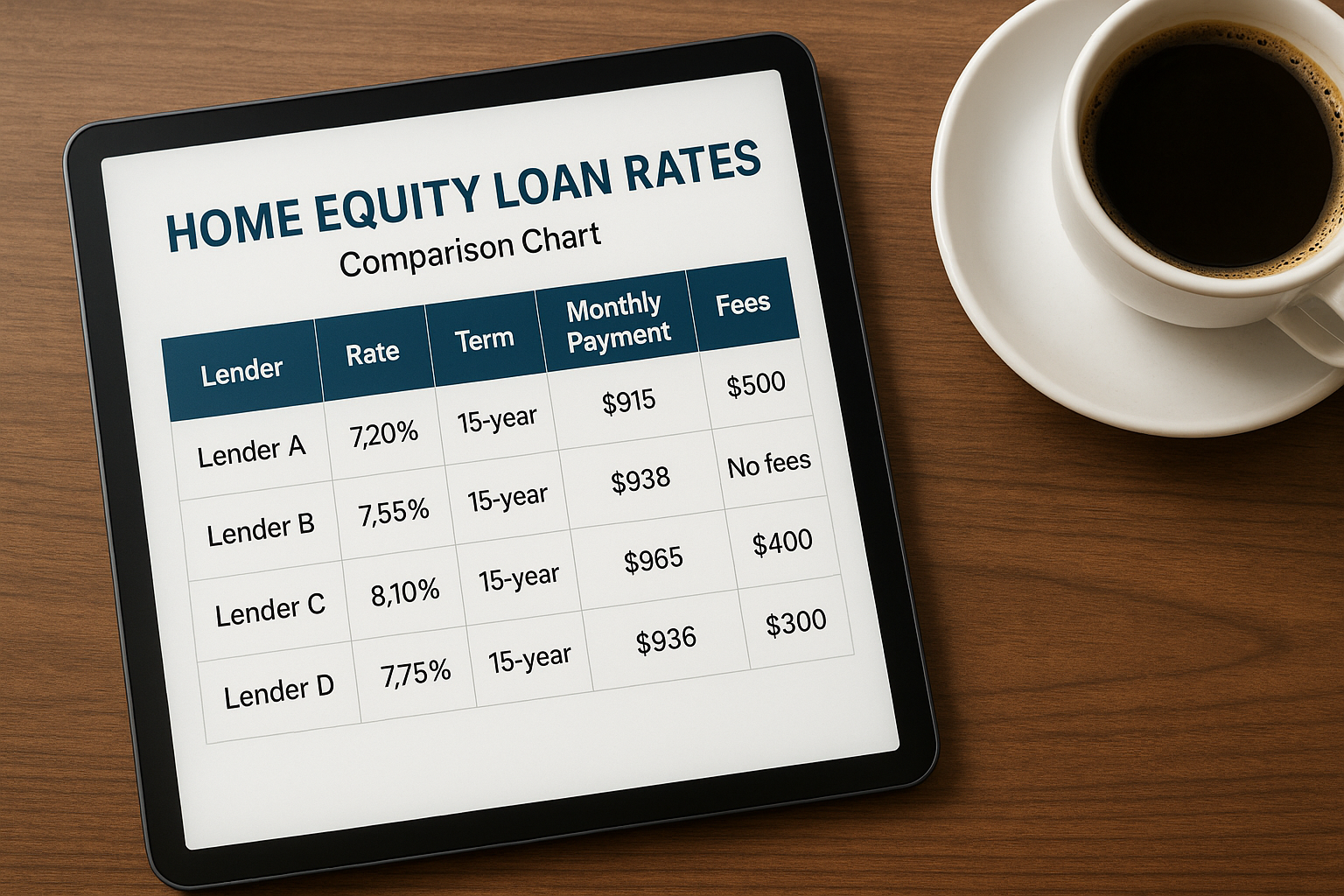

Why Compare Rates?

Comparing rates is crucial because even a small difference in interest rates can significantly impact your monthly payments and the total cost of the loan. For instance, a 0.5% difference in interest rates on a $100,000 loan could save you thousands of dollars over the life of the loan. By taking the time to search options and compare different lenders, you can ensure that you're getting the best possible deal.

Factors Affecting Home Equity Loan Rates

Several factors influence the rates offered by lenders. These include:

- Credit Score: A higher credit score can qualify you for lower interest rates1.

- Loan-to-Value Ratio: The amount you want to borrow compared to your home's value affects the rate2.

- Economic Conditions: Overall market conditions and the Federal Reserve's policies can impact rates3.

Steps to Secure the Best Rate

- Check Your Credit Report: Ensure your credit report is accurate and address any discrepancies to improve your score.

- Determine Your Home's Value: Get a professional appraisal or use online tools to estimate your home's current market value.

- Shop Around: Visit websites of various lenders to compare rates and terms. Consider both traditional banks and online lenders.

- Negotiate: Don't hesitate to negotiate with lenders to secure better terms, especially if you have a strong credit profile.

Real-World Examples

Many homeowners have successfully reduced their monthly payments by refinancing with a home equity loan at a lower rate. For example, a homeowner with a $200,000 mortgage at a 5% interest rate could save over $150 per month by refinancing to a 3.5% home equity loan. This not only reduces monthly expenses but also frees up cash for other financial goals4.

Additional Resources

If you're ready to explore your options, consider consulting with a financial advisor to assess your specific situation. Additionally, many online platforms offer tools and resources to help you compare rates and find the best loan for your needs.

By taking the time to understand the factors that affect home equity loan rates and actively comparing different offers, you can make an informed decision that enhances your financial well-being. Remember, the right loan is out there, and with a little research, you can find it.