Efficiently Maximize Gains With Tax Planning For Stock Options

Efficient tax planning for stock options can significantly boost your financial gains, and by browsing options or visiting websites dedicated to this topic, you can uncover strategies to maximize your returns while minimizing liabilities.

Understanding Stock Options

Stock options are a popular form of employee compensation, granting the right to buy company stock at a predetermined price. They are primarily divided into two types: Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). ISOs offer tax benefits but come with strict rules, while NSOs are more flexible but taxed as regular income1. Understanding the distinctions between these options is crucial for effective tax planning.

The Importance of Timing

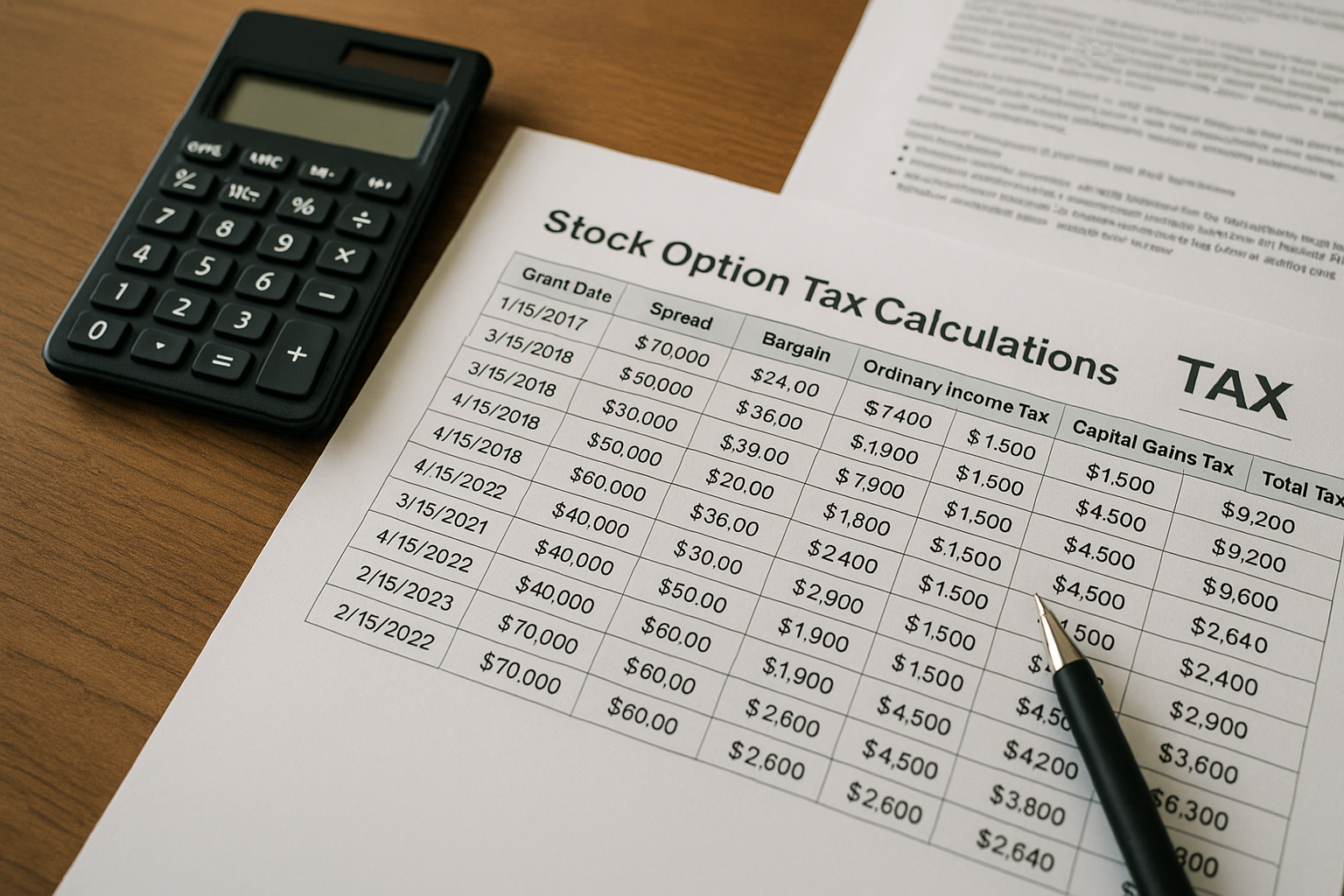

One of the key strategies in tax planning for stock options is timing. Exercising options when the market price is favorable can lead to significant savings. For ISOs, holding the shares for at least one year after exercising and two years after the grant date can qualify the gains for long-term capital gains tax rates, which are lower than ordinary income tax rates2. This timing strategy can be the difference between paying a 37% tax rate versus a 20% rate.

Tax Implications and Strategies

Tax implications vary based on the type of stock option. For NSOs, the difference between the exercise price and the market value is taxed as ordinary income. For ISOs, this difference is not taxed immediately but may be subject to the Alternative Minimum Tax (AMT). To mitigate AMT exposure, some individuals choose to exercise ISOs incrementally over several years3.

Another strategy involves donating appreciated stock to charity. This can help reduce taxable income while supporting a cause, making it a win-win situation. Additionally, consulting with a tax advisor can provide personalized strategies tailored to your financial situation, ensuring compliance while maximizing benefits.

Exploring Advanced Planning Techniques

Advanced techniques such as "cashless exercise" allow employees to use the proceeds from selling shares to cover the cost of exercising options, reducing out-of-pocket expenses. Furthermore, some companies offer programs that enable employees to sell a portion of their vested options to cover taxes and exercise costs, providing immediate liquidity4.

Resources and Professional Assistance

Navigating the complexities of tax planning for stock options can be challenging. Fortunately, numerous resources are available online, and visiting websites that specialize in financial planning can provide additional insights. Consulting with a financial advisor or tax professional can ensure that you are making informed decisions and taking advantage of all available opportunities.

In summary, efficiently maximizing gains with tax planning for stock options requires a comprehensive understanding of the types of options, timing strategies, and tax implications. By exploring specialized resources and seeking professional advice, you can optimize your financial outcomes and make the most of your stock options.