Get Fiduciary Insurance Quotes Fast Save Big Today

If you're looking to protect your financial interests and save on costs, getting fiduciary insurance quotes fast can help you browse options and see these opportunities to secure the best deals available today.

Understanding Fiduciary Insurance

Fiduciary insurance is essential for businesses that manage employee benefit plans, as it protects against claims of mismanagement of those plans. This type of insurance covers the legal liability of fiduciaries, who are responsible for overseeing the management and administration of employee benefits. It ensures that fiduciaries are protected from claims related to breaches of their duties, which could potentially result in significant financial losses.

The Importance of Fiduciary Insurance

Fiduciaries have a legal obligation to act in the best interest of plan participants and beneficiaries. However, even with the best intentions, mistakes can happen, leading to costly lawsuits. Fiduciary insurance provides a safety net by covering legal defense costs and any settlements or judgments that might arise from such claims. Without this coverage, businesses could face crippling financial burdens that could threaten their operations.

Types of Fiduciary Insurance Coverage

Fiduciary insurance typically includes coverage for:

- Legal defense costs: Covers attorney fees and other legal expenses incurred while defending against claims.

- Settlements and judgments: Provides funds to pay for any settlements or judgments awarded against the fiduciary.

- Errors and omissions: Protects against claims arising from mistakes or oversight in plan management.

Cost Factors and Savings Opportunities

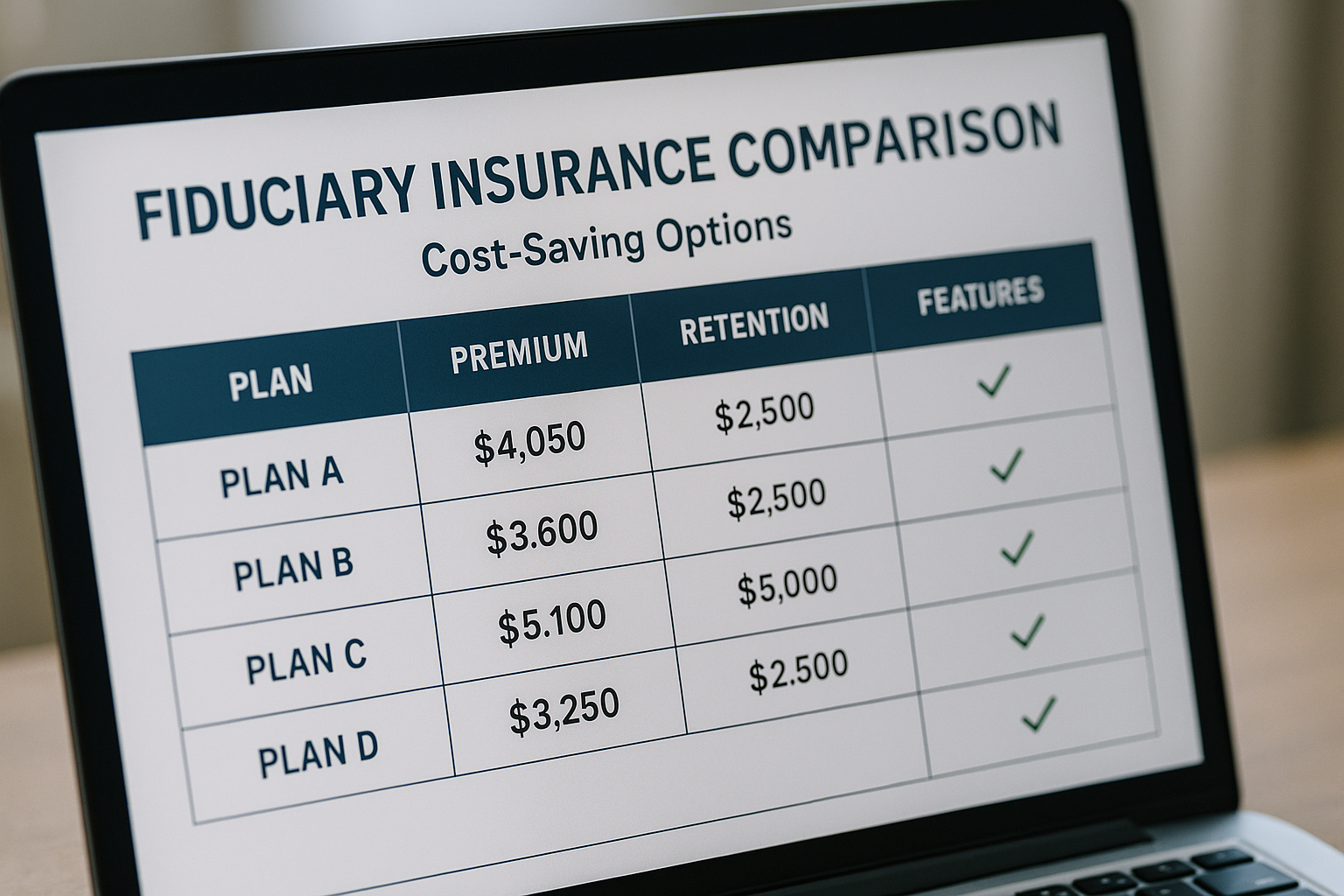

The cost of fiduciary insurance varies based on several factors, including the size of the company, the number of plan participants, and the total assets under management. On average, premiums can range from $1,000 to $5,000 annually for small to medium-sized businesses1. However, businesses can often find discounts by bundling fiduciary insurance with other types of coverage, such as general liability or directors and officers insurance.

How to Get Quotes Quickly

To get fiduciary insurance quotes fast, consider these steps:

- Assess Your Needs: Determine the level of coverage required based on the size and complexity of your employee benefit plans.

- Gather Information: Collect relevant data about your plans, such as the number of participants and total assets.

- Contact Multiple Providers: Reach out to several insurance carriers or brokers to compare quotes and coverage options.

- Evaluate Coverage Details: Carefully review the terms and conditions of each policy to ensure it meets your specific needs.

Real-World Examples

Consider a mid-sized company with 200 employees and a retirement plan worth $10 million. Without fiduciary insurance, a lawsuit alleging mismanagement could potentially cost the company hundreds of thousands in legal fees and settlements. By securing fiduciary insurance, the company not only protects its financial interests but also gains peace of mind knowing that it has a safety net in place.

Additional Resources and Specialized Services

For businesses seeking tailored solutions, many specialized insurance brokers offer comprehensive fiduciary insurance packages. These brokers can provide personalized advice and help navigate the complexities of policy selection to ensure optimal protection.

In summary, fiduciary insurance is a crucial investment for any business managing employee benefit plans. By understanding your coverage needs and exploring various options, you can secure the protection you need while potentially saving on costs. Take the time to visit websites and follow the options available to find the best fit for your business.