Get Unmatched RV Loan Financing Quote Save Big Now

If you're eager to hit the road in your dream RV without breaking the bank, now is the perfect time to browse options and secure an unmatched RV loan financing quote that can help you save big.

Understanding RV Loan Financing

The allure of the open road and the freedom of travel make recreational vehicles (RVs) a popular choice for many adventure enthusiasts. However, purchasing an RV can be a significant financial commitment. RV loan financing is a specialized service that helps potential buyers afford their dream vehicles by spreading the cost over a period. Typically, RV loans can be secured through banks, credit unions, or specialized lenders who understand the unique nature of RV ownership.

Types of RV Loan Options

When considering RV loan financing, it's crucial to understand the types of loans available to you:

1. **Secured Loans**: These loans require collateral, usually the RV itself, which can lead to lower interest rates. However, failure to repay may result in the lender repossessing the RV.

2. **Unsecured Loans**: These do not require collateral, but often come with higher interest rates due to the increased risk for lenders.

3. **Personal Loans**: While not specifically designed for RVs, personal loans can be used for such purchases, offering flexibility in terms of use but typically at higher interest rates.

Benefits of RV Loan Financing

Choosing the right RV loan can provide several benefits:

- **Affordability**: By spreading the cost over several years, RV loans make the purchase more affordable and manageable.

- **Fixed Interest Rates**: Most RV loans offer fixed interest rates, which means your monthly payments remain consistent throughout the loan term.

- **Tax Deductions**: In some cases, RVs can be considered a second home, making the interest on your loan potentially tax-deductible1.

How to Secure the Best RV Loan Financing

To secure the best RV loan financing, consider the following steps:

- **Check Your Credit Score**: A higher credit score can significantly impact the interest rate you receive. It's advisable to check and improve your credit score before applying.

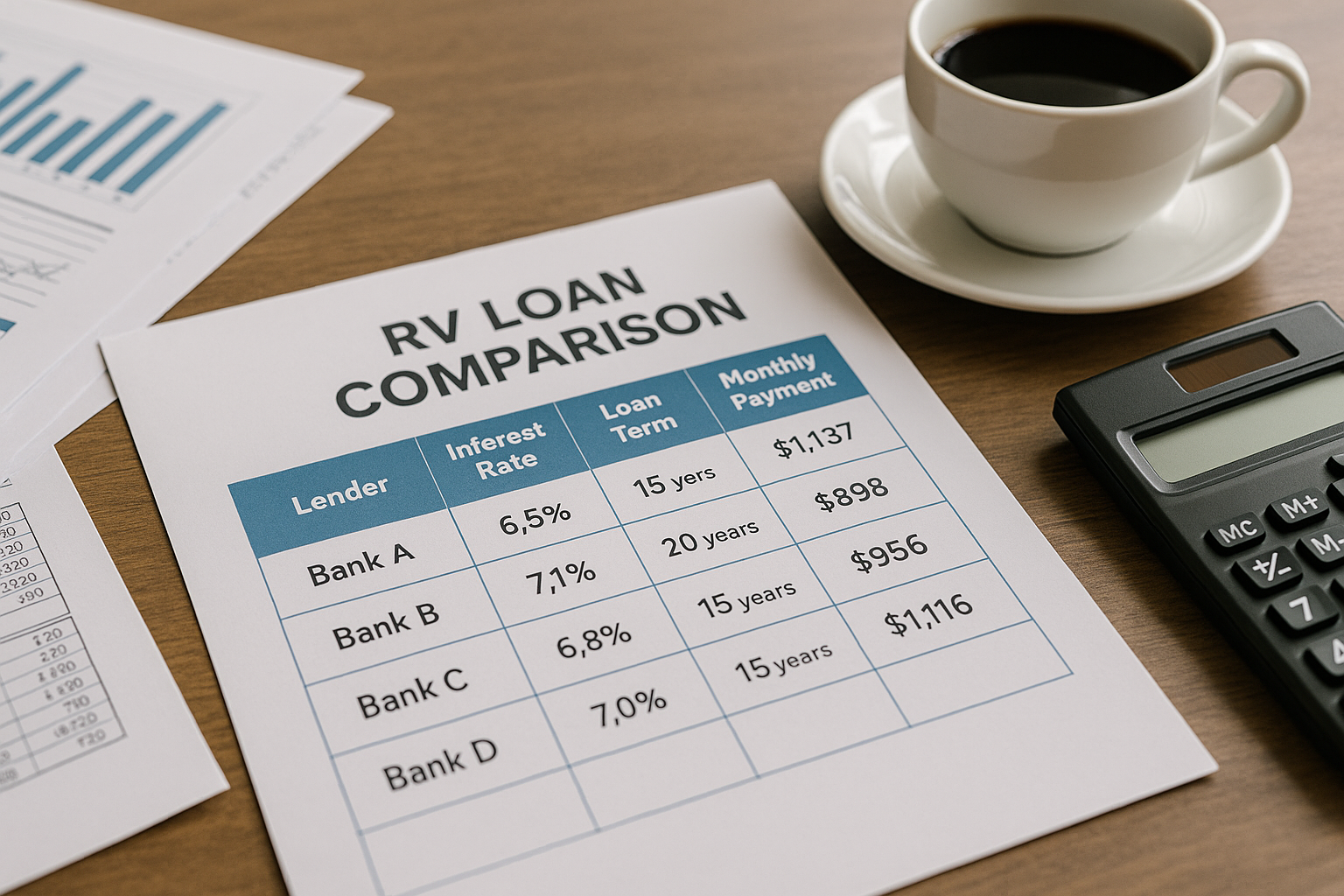

- **Compare Lenders**: Visit websites of various lenders to compare interest rates, terms, and conditions. Specialized RV lenders often offer more competitive rates.

- **Negotiate Terms**: Don’t hesitate to negotiate the terms of your loan. Some lenders may offer discounts or better rates for customers with strong credit histories.

- **Consider Loan Terms**: While longer loan terms mean lower monthly payments, they can also result in paying more interest over time. Balance your monthly budget with the overall cost of the loan.

Real-World Examples and Data

According to the RV Industry Association, RV ownership has been steadily increasing, with over 11 million households owning an RV in the United States2. The average cost of a new RV ranges from $10,000 to $300,000, depending on the type and model3. This wide range highlights the importance of finding the right financing option to suit your budget and lifestyle.

Exploring Additional Resources

For those ready to embark on their RV journey, it's beneficial to explore specialized services that offer tailored financing solutions. By searching options and visiting websites of reputable lenders, you can find competitive quotes that align with your financial goals.

Securing an RV loan is more than just a financial transaction; it's a step towards realizing your travel dreams. By taking the time to understand your financing options, comparing rates, and negotiating terms, you can ensure that your RV purchase is both affordable and rewarding. So, start your journey today by exploring the available resources and options that can help you save big on your RV loan.