Homeowners Insurance Replacement Cost Review Reveals Secret Savings

Are you ready to uncover hidden savings on homeowners insurance that could transform your financial outlook, while you browse options and explore tailored solutions?

Understanding Homeowners Insurance Replacement Cost

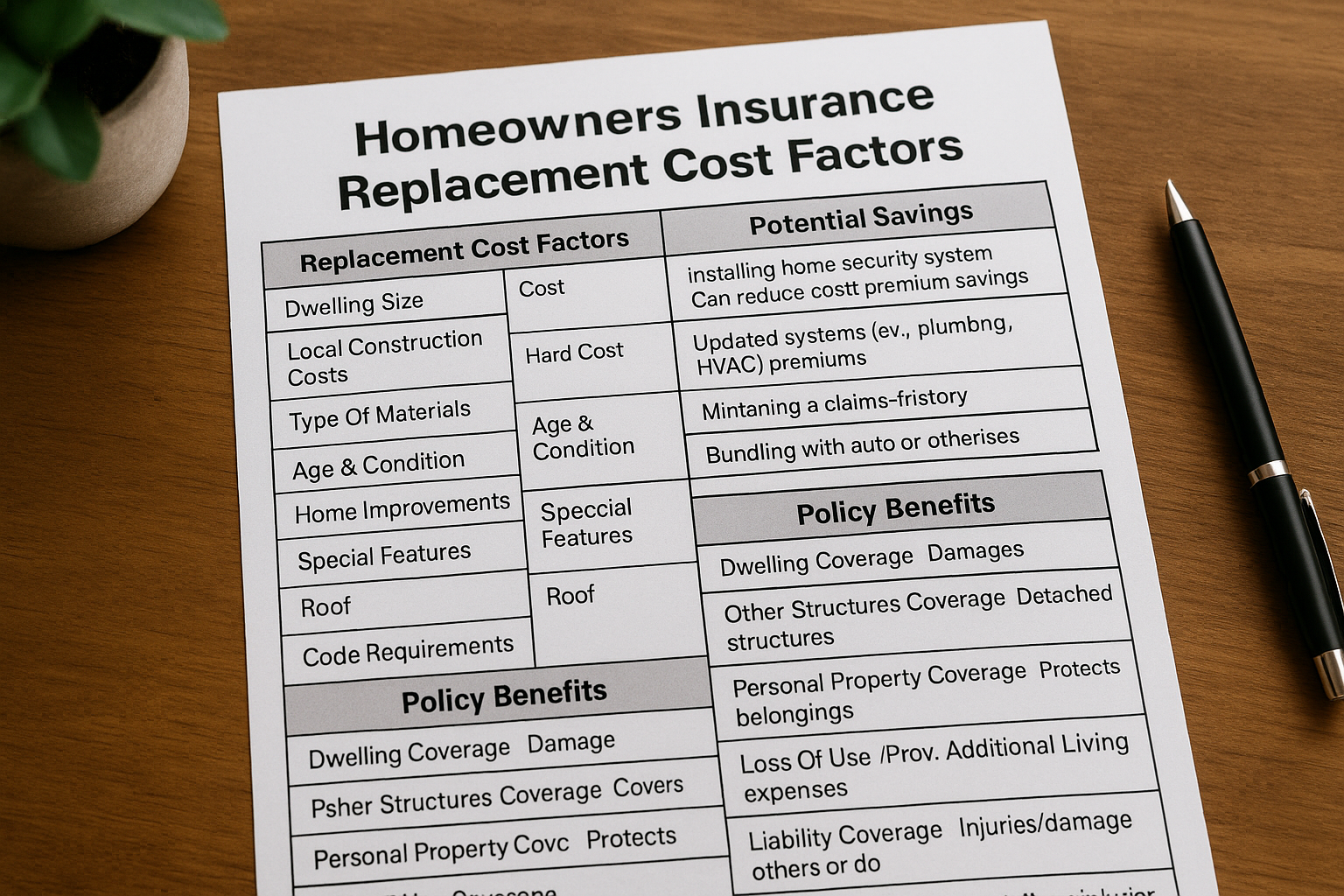

Homeowners insurance is an essential safeguard, protecting one of your most significant investments—your home. A crucial component of this insurance is the replacement cost coverage, which ensures your home can be rebuilt to its original state after a disaster. However, many homeowners are unaware of the potential savings that a thorough review of their replacement cost coverage can reveal.

The replacement cost is not the market value of your home, but rather the amount required to rebuild it from scratch. This includes costs for materials, labor, and even architectural fees. With fluctuating construction costs, it's important to regularly review your policy to ensure you're neither underinsured nor overpaying for unnecessary coverage.

Hidden Savings in Replacement Cost Reviews

One of the most significant opportunities for savings lies in regularly updating the replacement cost value of your home. Many policies are set with a fixed value that doesn't account for changes in construction costs or home improvements. By reassessing the replacement cost, you might discover you're over-insured and paying for more coverage than necessary.

Additionally, many insurance providers offer discounts for homes with updated safety features, such as modern electrical systems, storm-resistant windows, or advanced security systems. These improvements not only enhance your home's safety but can also reduce your insurance premiums. It's worthwhile to search options and see these options offered by different insurers.

Real-World Examples and Statistics

According to the Insurance Information Institute, homeowners who conduct regular reviews and updates to their policies can save up to 20% on premiums1. Furthermore, the National Association of Insurance Commissioners suggests that policyholders who bundle their home and auto insurance can see discounts ranging from 5% to 25%2.

In a practical example, a homeowner in California updated her policy to reflect recent renovations and found her premium reduced by 15% after her insurer acknowledged the improved safety features3. These real-world savings underscore the importance of staying proactive with your insurance policy.

Steps to Maximize Your Savings

To unlock the potential savings in your homeowners insurance, start by contacting your insurance agent to review your current policy. Ask for a detailed breakdown of your coverage, and inquire about any discounts you might be eligible for. If you've made improvements to your home, make sure these are reflected in your policy.

Next, compare your current policy against other offers in the market. Many insurers have online tools that allow you to get quotes based on updated information about your home. This is an excellent way to visit websites and compare the most competitive rates.

Finally, consider bundling your insurance policies. Many companies offer significant discounts for customers who choose to bundle their home and auto insurance, providing an easy way to reduce your overall insurance costs.

By taking these steps, you can ensure your homeowners insurance provides the right coverage at the best possible price, all while keeping your finances in check. Remember, a simple review could lead to substantial savings, making it a worthwhile endeavor to follow the options available to you.