Maximize Savings with Essential EPLI Insurance Renewal Strategy

Are you looking to secure your business while keeping costs down? Discover how a strategic approach to Employment Practices Liability Insurance (EPLI) renewal can help you maximize savings and protect your company, and don't miss the chance to browse options that fit your needs perfectly.

Understanding EPLI: A Key Component of Business Protection

Employment Practices Liability Insurance (EPLI) is an essential safeguard for any business, offering coverage against claims made by employees alleging discrimination, wrongful termination, harassment, and other employment-related issues. As businesses navigate complex legal landscapes, EPLI becomes a crucial component of risk management. The costs associated with employee lawsuits can be significant, making EPLI a wise investment to protect your financial interests.

The Importance of a Strategic Renewal Process

Renewing your EPLI policy isn't just a routine task; it's a strategic opportunity to reassess your coverage needs and potentially lower your premiums. By carefully evaluating your current policy, you can identify areas for improvement and negotiate better terms. This proactive approach not only ensures continued protection but also helps in maintaining budgetary efficiency.

Steps to Maximize Savings on EPLI Renewal

When approaching your EPLI renewal, consider these critical steps to maximize savings:

- Review Your Current Policy: Begin by thoroughly examining your existing EPLI policy. Look for coverage gaps, unnecessary provisions, or outdated terms that may not align with your current business operations. This review can reveal opportunities to adjust your coverage and reduce costs.

- Assess Your Risk Profile: Understanding your company's risk profile is vital. Factors such as the number of employees, industry type, and past claims history can influence your EPLI premiums. By demonstrating a lower risk profile, you can negotiate more favorable terms with insurers.

- Implement Risk Management Practices: Insurers often offer discounts to businesses that implement effective risk management practices. Consider training programs for employees, updated HR policies, and a robust compliance framework to reduce the likelihood of claims.

- Shop Around: Don't settle for the first renewal offer you receive. Take the time to browse and compare options from multiple insurers. This competitive approach can lead to better coverage at a lower cost.

- Negotiate Terms: Engage with your insurer to negotiate better terms. Highlight any improvements in your risk profile and emphasize your commitment to maintaining a safe and compliant workplace.

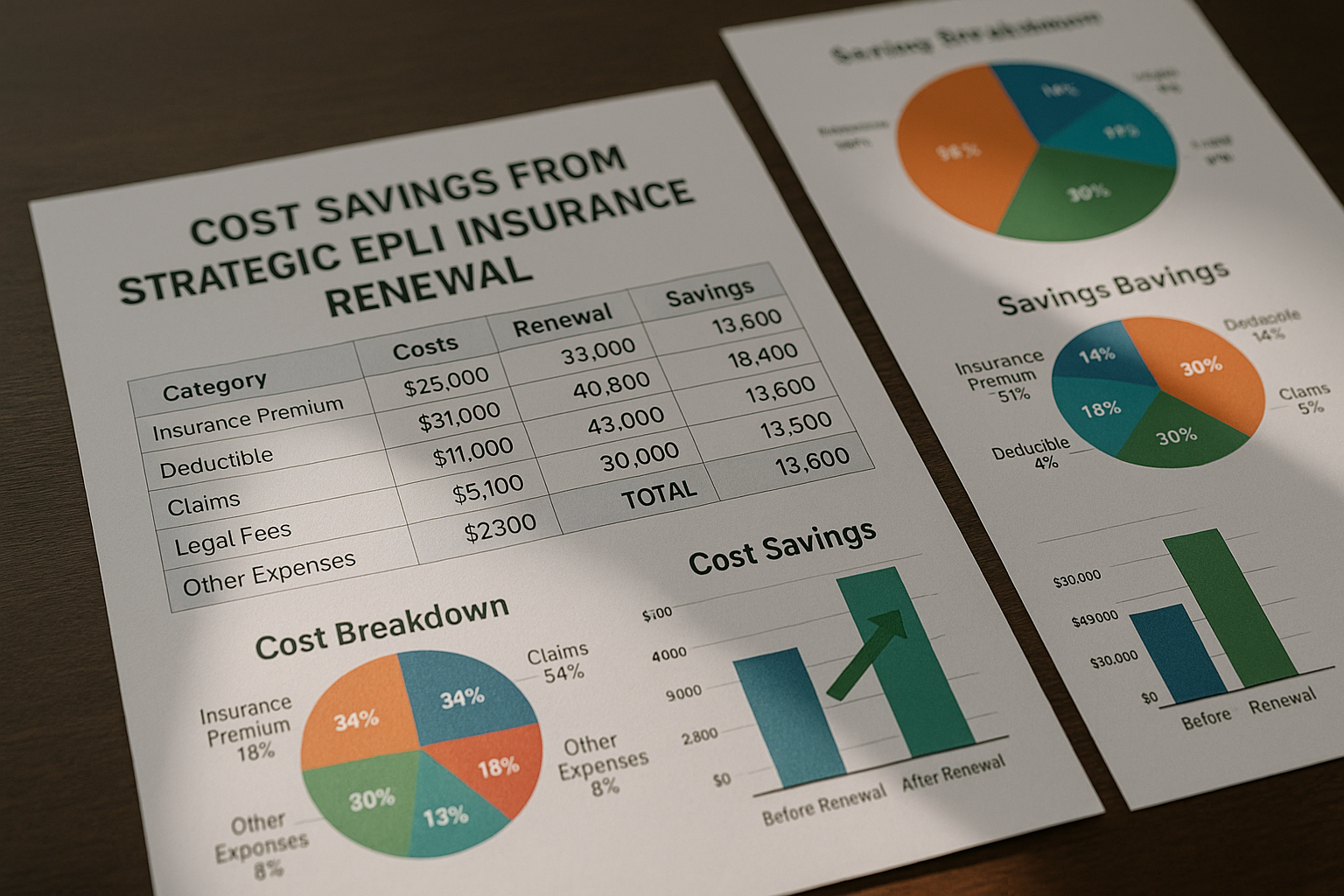

Real-World Savings and Statistics

According to industry reports, businesses that actively engage in policy reviews and negotiations during renewal can save up to 20% on their EPLI premiums1. Moreover, implementing comprehensive risk management strategies can further reduce premium costs by an additional 10-15%2. These savings not only enhance your bottom line but also ensure that your business remains protected against potential legal challenges.

Exploring Specialized Solutions

For businesses seeking tailored solutions, consulting with a specialized insurance broker can provide valuable insights. Brokers have access to a wide range of insurance products and can help you navigate the complexities of EPLI coverage. They can assist in finding policies that are specifically designed to meet your unique needs, ensuring comprehensive protection while maximizing savings.

By following these strategic steps and exploring specialized options, you can effectively manage your EPLI renewal process, ensuring robust coverage and significant cost savings. As you embark on this journey, remember to visit websites and search options that offer the best deals tailored to your business needs.