Retire Smart Compare Reverse Mortgage Lender Secrets Today

If you're looking to unlock the secrets of reverse mortgage lenders and make informed retirement decisions, now is the perfect time to browse options and explore the potential benefits that could enhance your financial future.

Understanding Reverse Mortgages

Reverse mortgages have become a popular financial tool for retirees seeking to supplement their income. Unlike traditional mortgages, a reverse mortgage allows homeowners aged 62 and older to convert part of their home equity into cash without having to sell their home or take on additional monthly payments. This financial product can be particularly beneficial for those who are "house-rich but cash-poor," providing them with the liquidity they need to enjoy their retirement years.

How Reverse Mortgages Work

A reverse mortgage is essentially a loan against the equity of your home. The amount you can borrow depends on several factors, including your age, the value of your home, and current interest rates. The loan doesn't need to be repaid until the homeowner sells the house, moves out permanently, or passes away. At that point, the proceeds from the sale of the home are used to repay the loan, with any remaining equity going to the homeowner or their heirs.

Types of Reverse Mortgages

There are three main types of reverse mortgages:

- Home Equity Conversion Mortgages (HECMs): These are federally insured by the U.S. Department of Housing and Urban Development (HUD) and are the most common type of reverse mortgage. They offer flexible payment options and are available through HUD-approved lenders.

- Proprietary Reverse Mortgages: These are private loans not insured by the government. They are designed for homeowners with higher-valued homes and may offer larger loan amounts than HECMs.

- Single-Purpose Reverse Mortgages: Typically offered by state and local government agencies or nonprofit organizations, these loans are intended for specific purposes, such as home repairs or property taxes.

Benefits of Reverse Mortgages

Reverse mortgages offer several advantages. They provide a steady income stream, allowing retirees to maintain their standard of living without the need to sell their home. Additionally, the funds received from a reverse mortgage are typically tax-free, which can be a significant benefit for retirees on a fixed income1.

Costs and Considerations

While reverse mortgages can be beneficial, it's important to consider the costs involved. These can include origination fees, mortgage insurance premiums, and closing costs. Potential borrowers should also be aware that a reverse mortgage will reduce the equity in their home, which could impact their estate planning or the inheritance left to their heirs2.

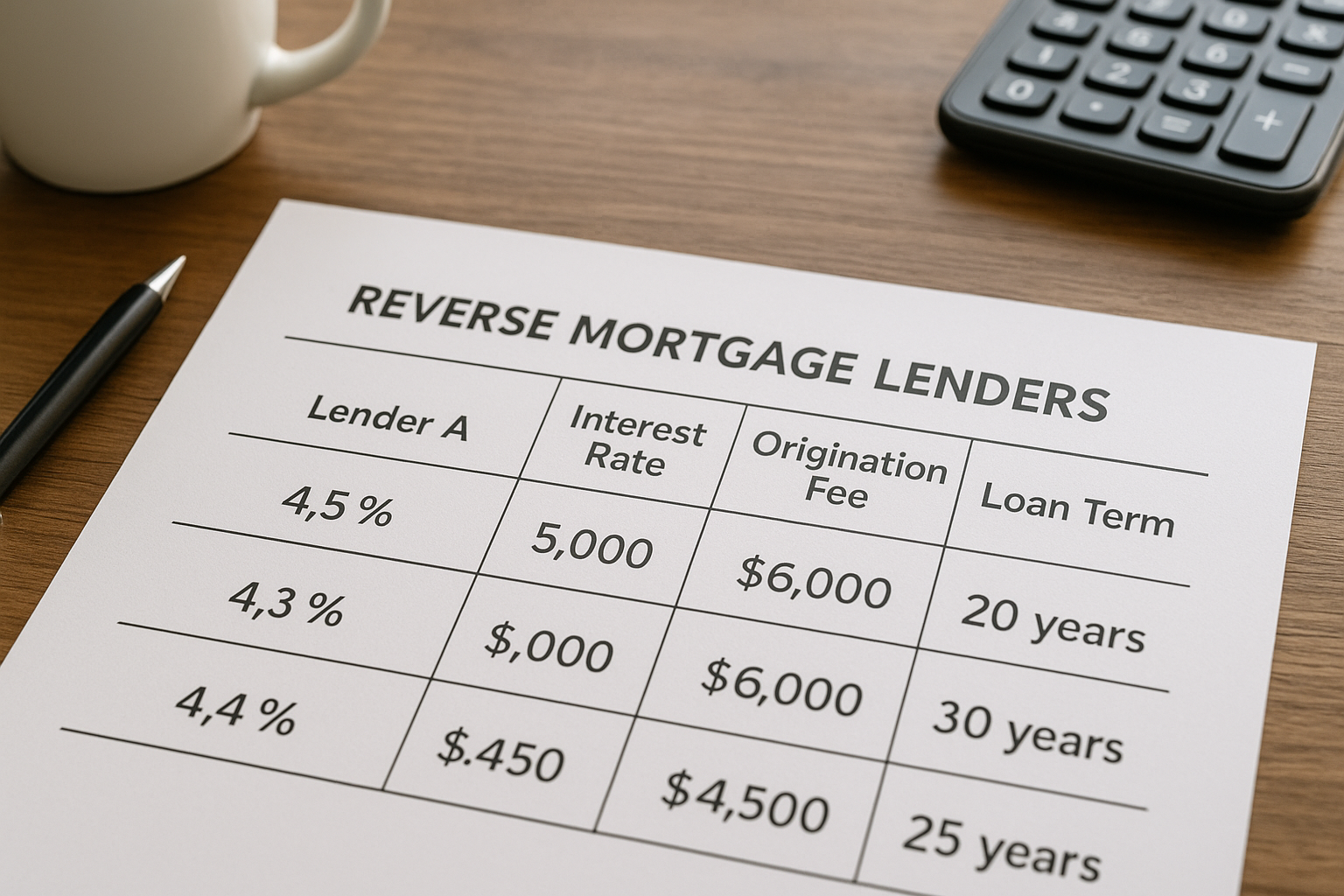

Choosing the Right Lender

Selecting the right reverse mortgage lender is crucial for ensuring the best terms and conditions. It's advisable to compare multiple lenders, taking into account their reputation, customer service, and the specific terms they offer. Many lenders provide online resources and calculators that can help you understand the potential costs and benefits of a reverse mortgage3.

Exploring Your Options

For those interested in reverse mortgages, it's essential to research and evaluate the various options available. Consider consulting with a financial advisor to understand how a reverse mortgage fits into your overall retirement strategy. Many resources are available online to help guide you through the process of finding a reputable lender and understanding the terms of the loan4.

Ultimately, reverse mortgages can offer a viable solution for retirees seeking to enhance their financial stability. By understanding the different types of reverse mortgages, their benefits, and potential costs, you can make an informed decision that aligns with your retirement goals. Take the time to explore these options and ensure that you're making the best choice for your future.