Revolutionize 3PL Success With Better Insurance Quote Choices

By choosing the right insurance quotes for your third-party logistics (3PL) operations, you can significantly enhance your business's resilience and profitability, so explore these options to uncover the best deals and protection for your company.

Understanding the Importance of Insurance in 3PL

In the dynamic world of third-party logistics, managing risks is as critical as managing cargo. Insurance plays a pivotal role in safeguarding your business against unforeseen events such as cargo damage, theft, or liability issues. With the right insurance policy, you can protect your assets, ensure smooth operations, and maintain your reputation in the industry. However, navigating the myriad of insurance options can be daunting. That's why it's crucial to understand what specific coverages are available and how they can directly impact your business's bottom line.

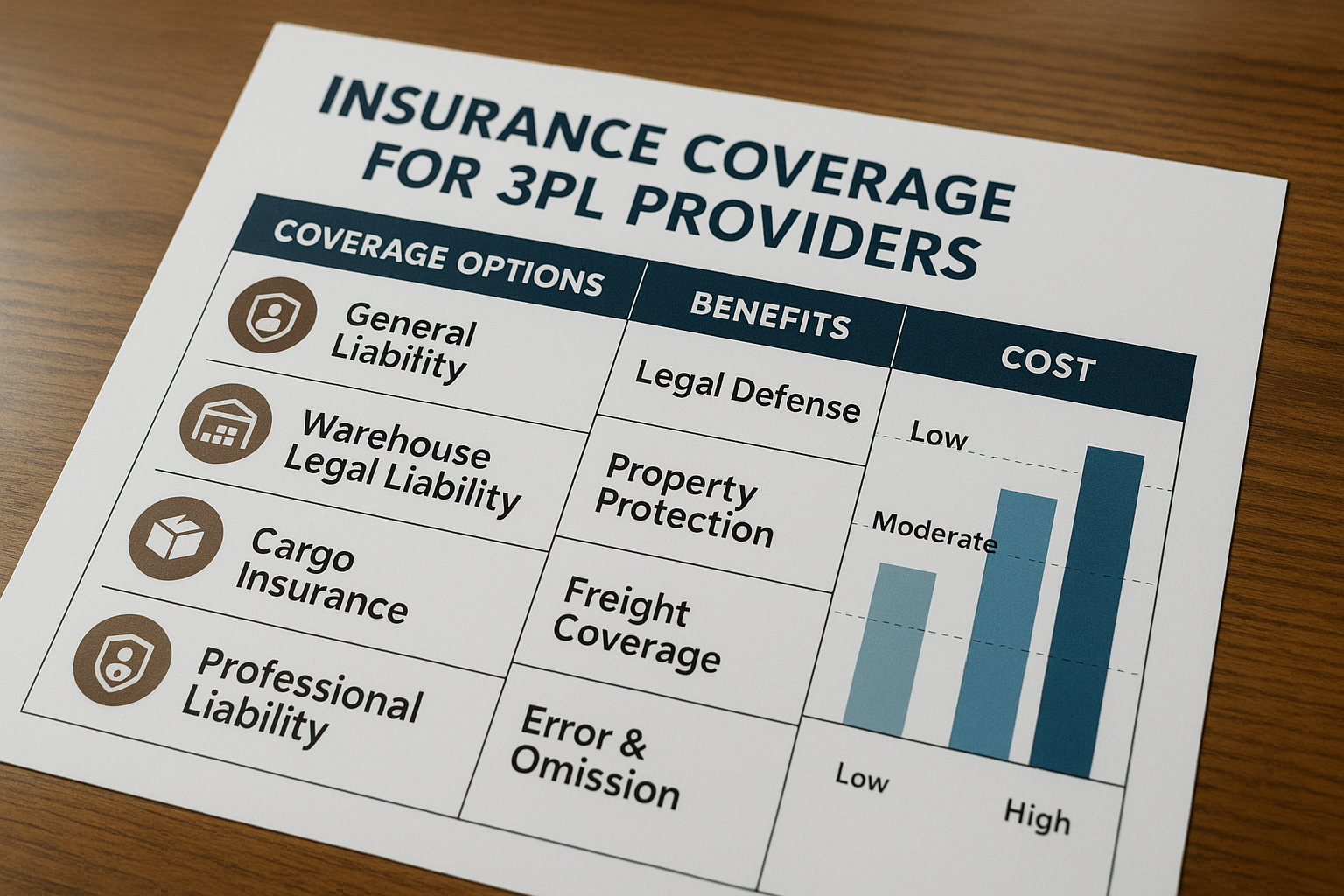

Types of Insurance Coverage for 3PL Companies

3PL companies typically require a range of insurance policies to cover different aspects of their operations:

- General Liability Insurance: This covers legal liabilities arising from bodily injuries or property damage that occur during business operations. It's essential for protecting against claims that could financially cripple a business.

- Cargo Insurance: This policy protects against loss or damage to goods while they are in transit. Given the high value of transported goods, cargo insurance is indispensable for 3PL companies.

- Professional Liability Insurance: Also known as errors and omissions insurance, this covers claims related to negligence, errors, or omissions in the services provided.

- Workers' Compensation Insurance: This is mandatory in most regions and covers medical expenses and lost wages for employees injured on the job.

Financial Considerations and Cost-Saving Opportunities

Insurance premiums can significantly impact a 3PL company's financial health. Therefore, it's important to shop around and compare quotes to find the best deal. Many insurers offer discounts for bundling multiple policies, which can lead to substantial savings. Additionally, maintaining a good claims history and implementing robust risk management strategies can also reduce premiums over time.

According to industry data, companies that proactively manage risks can see up to a 15% reduction in insurance costs1. This underscores the importance of working closely with insurance providers to tailor policies that align with your specific operational needs.

Choosing the Right Insurance Provider

When selecting an insurance provider, consider their experience in the logistics industry, the range of coverage options they offer, and their claims handling process. A provider with a strong track record in 3PL insurance can offer valuable insights and customized solutions that a general insurer might miss. Additionally, it's worthwhile to read customer reviews and ratings to gauge the provider's reliability and customer service quality.

Moreover, leveraging online platforms to browse and compare insurance options can streamline the selection process. Websites that aggregate quotes from multiple insurers allow you to efficiently assess and select the most suitable policies for your business needs.

Real-World Examples and Success Stories

Consider the example of a mid-sized 3PL company that managed to cut its insurance costs by 20% by switching providers and bundling its policies2. By taking the time to thoroughly research and compare options, they not only reduced expenses but also improved their coverage, ensuring better protection for their operations.

Another case involves a logistics firm that implemented a comprehensive risk management program, resulting in fewer claims and a subsequent decrease in premium rates. This approach not only enhanced their operational efficiency but also bolstered their financial stability3.

Ultimately, the right insurance choices can revolutionize your 3PL success. By exploring various options and tailoring your coverage to meet your specific needs, you can protect your business, enhance your competitiveness, and achieve greater peace of mind. For those seeking specialized solutions or further insights, numerous resources and expert consultations are available online to guide your decision-making process.