Score Exclusive Condo Insurance HO-6 Policy Quotes Today

Unlock the peace of mind that comes with knowing your condo is protected by exploring a range of tailored HO-6 insurance policy quotes today, and see these options that cater to your specific needs and budget.

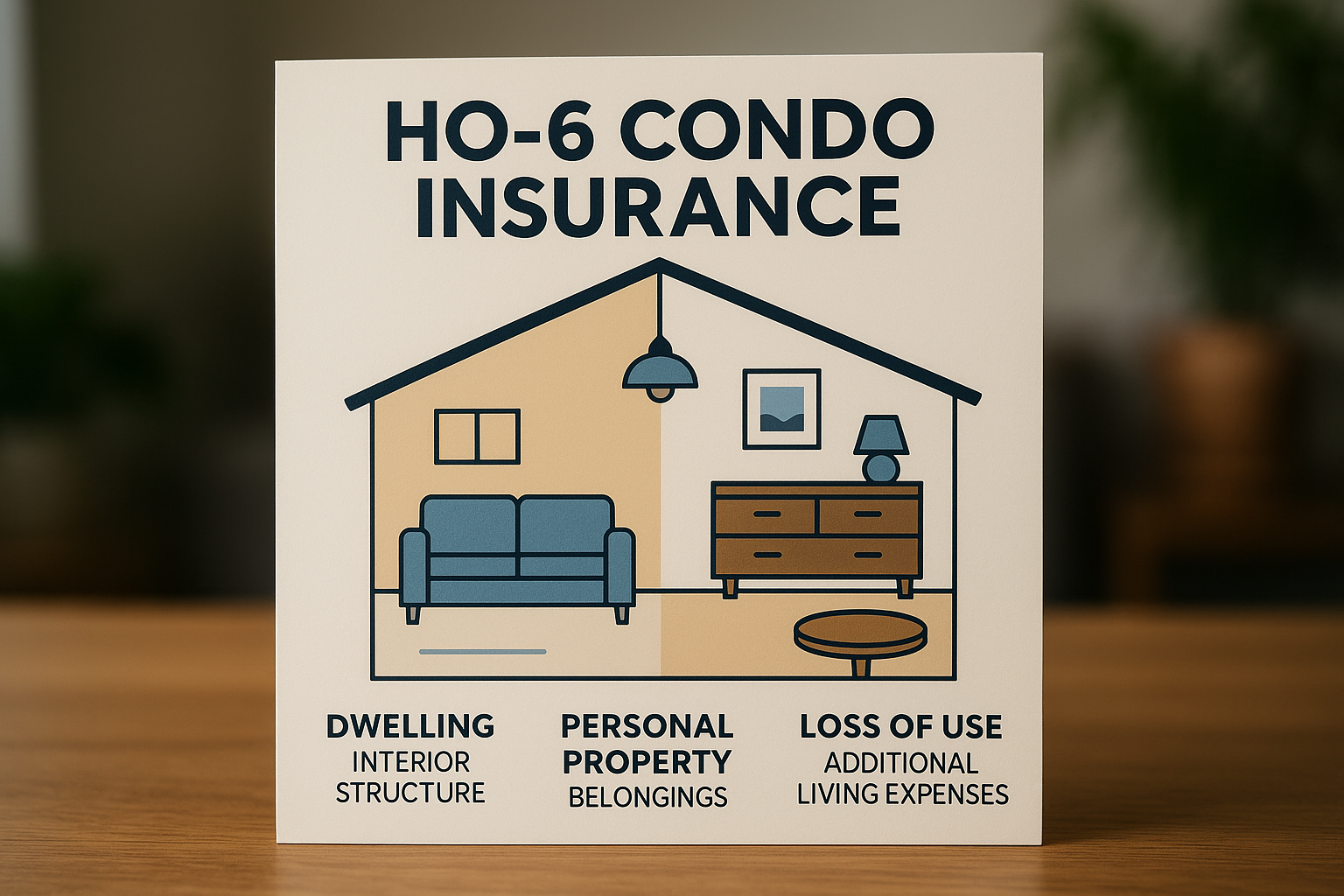

Understanding HO-6 Condo Insurance

HO-6 insurance, commonly referred to as condo insurance, is designed specifically for condominium owners. This type of policy provides a unique blend of coverage that protects your personal belongings, interior fixtures, and liability within your unit. Unlike traditional homeowners insurance, which covers the entire structure, HO-6 policies focus on what’s inside your walls, making it crucial for condo owners who want to safeguard their investments.

Condo associations typically have a master insurance policy, but this only covers the building's exterior and common areas. Your HO-6 policy steps in to fill the gaps, covering personal property, improvements you’ve made to your unit, and any liability issues that arise within your space. This tailored coverage is essential for preventing financial loss from unexpected events like theft, fire, or water damage.

Key Benefits of HO-6 Insurance

Opting for a condo insurance policy brings a host of benefits beyond basic protection. Firstly, it provides personal property coverage, ensuring that your belongings are insured against perils such as fire, theft, and vandalism. Secondly, it includes loss of use coverage, which compensates you for additional living expenses if your unit becomes uninhabitable due to a covered peril. Furthermore, liability coverage protects you if someone is injured in your condo or if you accidentally cause damage to another unit.

Another significant advantage is the ability to customize your policy with endorsements for high-value items like jewelry or electronics. This customization ensures that you have comprehensive coverage tailored to your unique needs, offering peace of mind in the face of potential risks.

Factors Influencing HO-6 Insurance Costs

The cost of HO-6 insurance can vary widely based on several factors. The location of your condo plays a significant role, as areas with higher crime rates or susceptibility to natural disasters may see higher premiums. The value of your personal property and the amount of coverage you choose also impact the cost. Additionally, your claims history can influence your premiums, with fewer claims often leading to lower rates.

To get the best deal, it's essential to compare quotes from multiple providers. Look for discounts that may be available, such as bundling your condo insurance with other policies or installing safety features like smoke detectors and security systems. These steps can significantly reduce your premiums while maintaining robust coverage.

How to Secure the Best HO-6 Insurance Quotes

To find the most competitive HO-6 insurance quotes, start by assessing your coverage needs. Consider the value of your personal belongings, any upgrades or improvements you’ve made to your unit, and potential liability risks. Once you have a clear understanding of your requirements, browse options from various insurance providers to compare coverage levels and premiums.

Don’t hesitate to visit websites of well-known insurers to see these options and request personalized quotes. Many companies offer online tools that allow you to customize your policy and see how different coverage levels affect your premiums. Additionally, working with an independent insurance agent can provide valuable insights and help you navigate the nuances of different policies.

By taking a proactive approach and exploring a variety of options, you can secure a comprehensive HO-6 insurance policy that offers the protection and peace of mind you need as a condo owner.