Secure Top Fiduciary Insurance Exclusively for Accounting Firms

When it comes to protecting your accounting firm, securing top fiduciary insurance is not just a wise choice—it's a critical necessity, and by taking the time to browse options, you can ensure you're getting the best coverage tailored to your specific needs.

Understanding Fiduciary Insurance for Accounting Firms

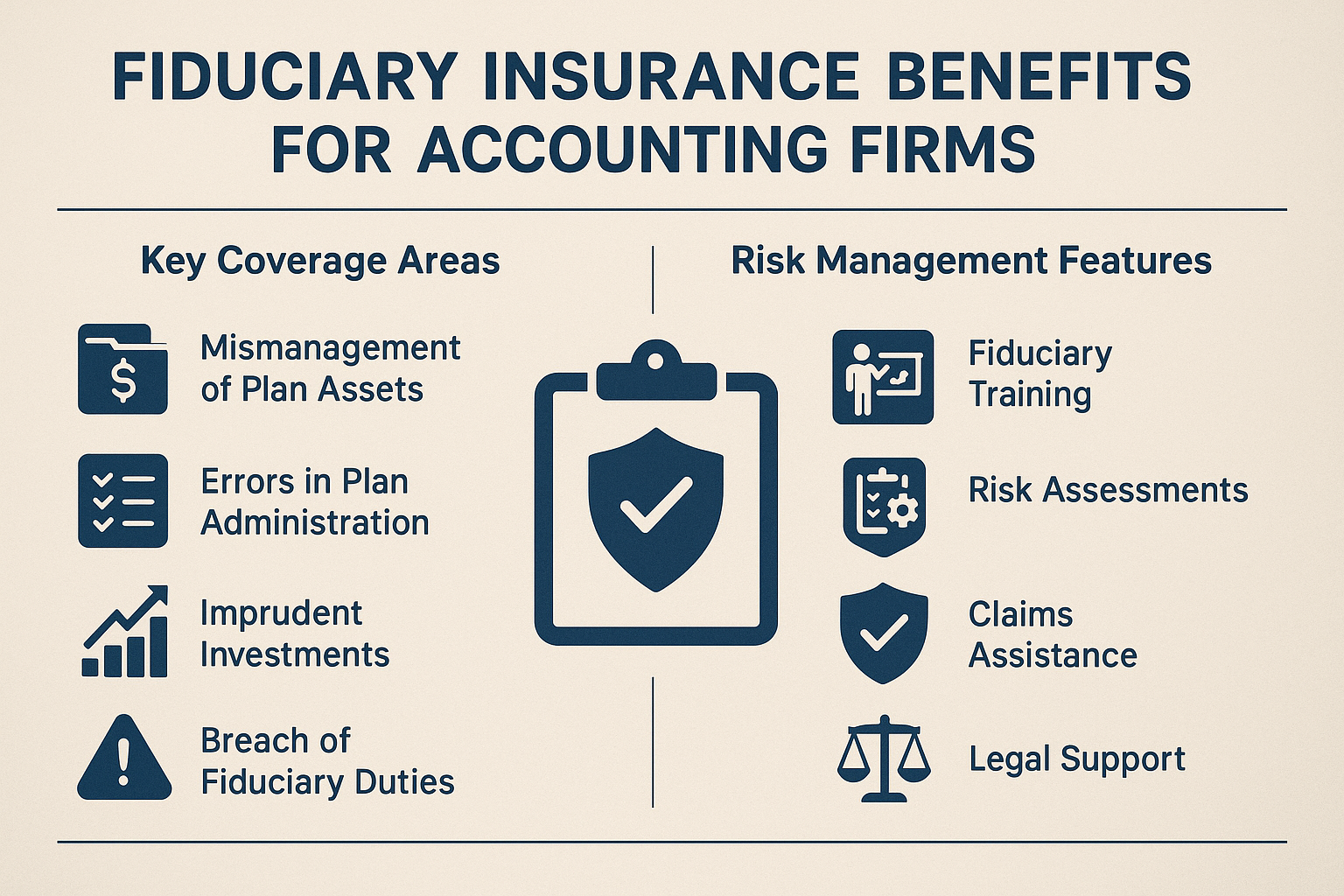

Fiduciary insurance is designed to protect businesses that manage employee benefit plans, including accounting firms, from claims of mismanagement. As an accounting firm, you are entrusted with handling sensitive financial information and guiding clients through complex financial landscapes. This insurance provides a safety net against potential lawsuits stemming from alleged breaches of fiduciary duty, such as errors in plan administration, conflicts of interest, or mismanagement of funds.

With the rise in litigation related to fiduciary responsibilities, having this insurance is increasingly crucial. According to a report by the U.S. Department of Labor, fiduciary breaches can lead to significant financial penalties and legal costs1. Thus, ensuring your firm is covered can safeguard against these potential financial burdens.

Key Benefits of Fiduciary Insurance

Fiduciary insurance offers several benefits that are particularly advantageous for accounting firms:

- Legal Protection: It covers the costs associated with defending against fiduciary duty claims, including legal fees and settlements.

- Financial Security: Protects the firm's assets by covering losses resulting from fiduciary breaches.

- Reputation Management: Helps maintain the firm's reputation by providing resources for crisis management and public relations in the event of a claim.

Moreover, many insurance providers offer customizable policies that can be tailored to the specific needs of your firm, ensuring comprehensive protection without paying for unnecessary coverage.

How to Secure the Best Coverage

When looking to secure fiduciary insurance, it's important to compare policies and providers to find the best fit for your firm. Here are some steps to guide you:

- Assess Your Needs: Evaluate your firm's exposure to fiduciary risks and determine the level of coverage required.

- Compare Policies: Browse options from multiple insurers to compare coverage limits, exclusions, and premiums.

- Consult with Experts: Engage with insurance brokers or consultants who specialize in fiduciary insurance to gain insights into the best policies available.

- Review Provider Reputation: Research potential insurers to ensure they have a strong track record in handling claims and supporting clients.

By following these steps, you can secure a policy that not only meets your firm's current needs but also provides flexibility for future growth and changes in fiduciary responsibilities.

Cost Considerations and Potential Savings

The cost of fiduciary insurance varies based on several factors, including the size of the firm, the number of employees, and the scope of services offered. On average, premiums can range from $1,000 to $5,000 annually2. However, many insurers offer discounts for firms with robust risk management practices or those that bundle fiduciary insurance with other types of coverage, such as professional liability insurance.

Investing in fiduciary insurance is not only a safeguard against potential losses but also a strategic move that can enhance your firm's credibility and client trust. By securing top fiduciary insurance, you position your firm as a responsible and reliable partner in financial management.

As you explore the various options available, remember that the right fiduciary insurance policy is an investment in the stability and success of your accounting firm. Take the time to visit websites and consult with professionals to ensure you're making an informed decision that aligns with your firm's long-term goals.