Slash Continuing Care Retirement Community CCRC costs smartly today

If you're looking to slash Continuing Care Retirement Community (CCRC) costs smartly today, you'll want to explore expert strategies and browse options that can help you make financially sound decisions while ensuring a comfortable and secure future.

Understanding Continuing Care Retirement Communities

Continuing Care Retirement Communities (CCRCs) offer a unique blend of independent living, assisted living, and skilled nursing care, providing residents with a continuum of care that adapts to their changing needs. This model is particularly appealing to retirees seeking a stable environment where they can age in place without the need to relocate as their health needs evolve. However, the cost of CCRCs can be substantial, necessitating strategic planning and savvy financial management.

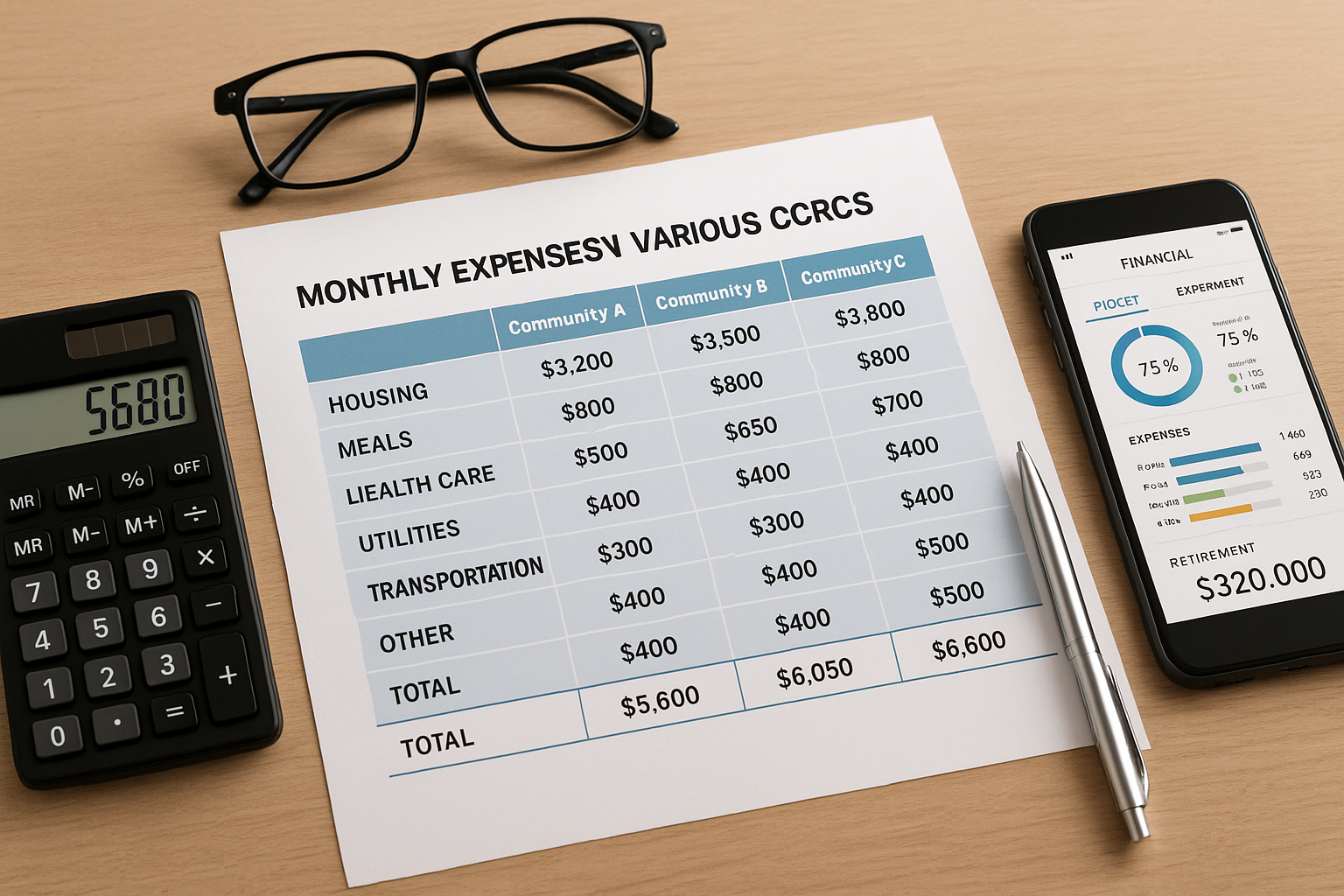

Breaking Down CCRC Costs

CCRCs typically require an entrance fee, which can range from $100,000 to over $1 million, depending on the location, type of housing, and level of care1. In addition to the upfront cost, residents pay a monthly fee that covers services such as meals, housekeeping, and healthcare. These monthly fees can range from $2,000 to $5,000 or more2. Understanding these costs is crucial for budgeting and financial planning.

Strategies for Reducing CCRC Expenses

1. **Evaluate Entrance Fee Options**: Some CCRCs offer refundable entrance fees, which can be a wise choice if you want to preserve assets for heirs. While these options may come with higher monthly fees, they can ultimately provide financial security and peace of mind3.

2. **Consider Contract Types**: CCRCs offer different contract types, such as Life Care, Modified, and Fee-for-Service contracts. Each has distinct financial implications. Life Care contracts, for example, provide comprehensive services for a fixed monthly fee, potentially offering significant savings in the long run4.

3. **Explore Financial Assistance Programs**: Some states offer financial assistance programs for seniors entering CCRCs. These programs can help offset costs, making CCRCs more accessible to a broader range of retirees5.

Maximizing Value in a CCRC

To truly maximize the value of a CCRC, it’s essential to assess the full range of services and amenities offered. Many CCRCs provide wellness programs, recreational activities, and social events that enhance the quality of life. By taking full advantage of these offerings, residents can enjoy a vibrant and fulfilling retirement while ensuring they receive excellent value for their investment.

Additional Resources and Specialized Options

For those seeking more tailored solutions, there are specialized services and resources available that can help in selecting the right CCRC. Consulting with a financial advisor who specializes in retirement planning can provide personalized strategies to manage costs effectively. Additionally, visiting websites that compare different CCRCs can offer valuable insights into pricing, services, and resident satisfaction.

In summary, by exploring various entrance fee options, understanding contract types, and seeking financial assistance programs, you can significantly reduce your CCRC costs. As you navigate this important decision, remember to browse options and consult available resources to ensure a financially sound and fulfilling retirement in a CCRC.