Slash Costs Instantly With This Self Funded Insurance Secret

Slash your insurance costs instantly by exploring this self-funded insurance secret, where you can browse options and find tailored solutions that align with your financial goals.

Understanding Self-Funded Insurance

Self-funded insurance, also known as self-insured plans, is a strategy where employers pay for employee healthcare costs directly, rather than purchasing a traditional insurance policy. This approach allows businesses to have greater control over their healthcare expenses and can lead to significant savings. By opting for self-funded insurance, companies can customize their plans to suit their workforce's specific needs, potentially reducing unnecessary coverage costs.

How Self-Funded Insurance Works

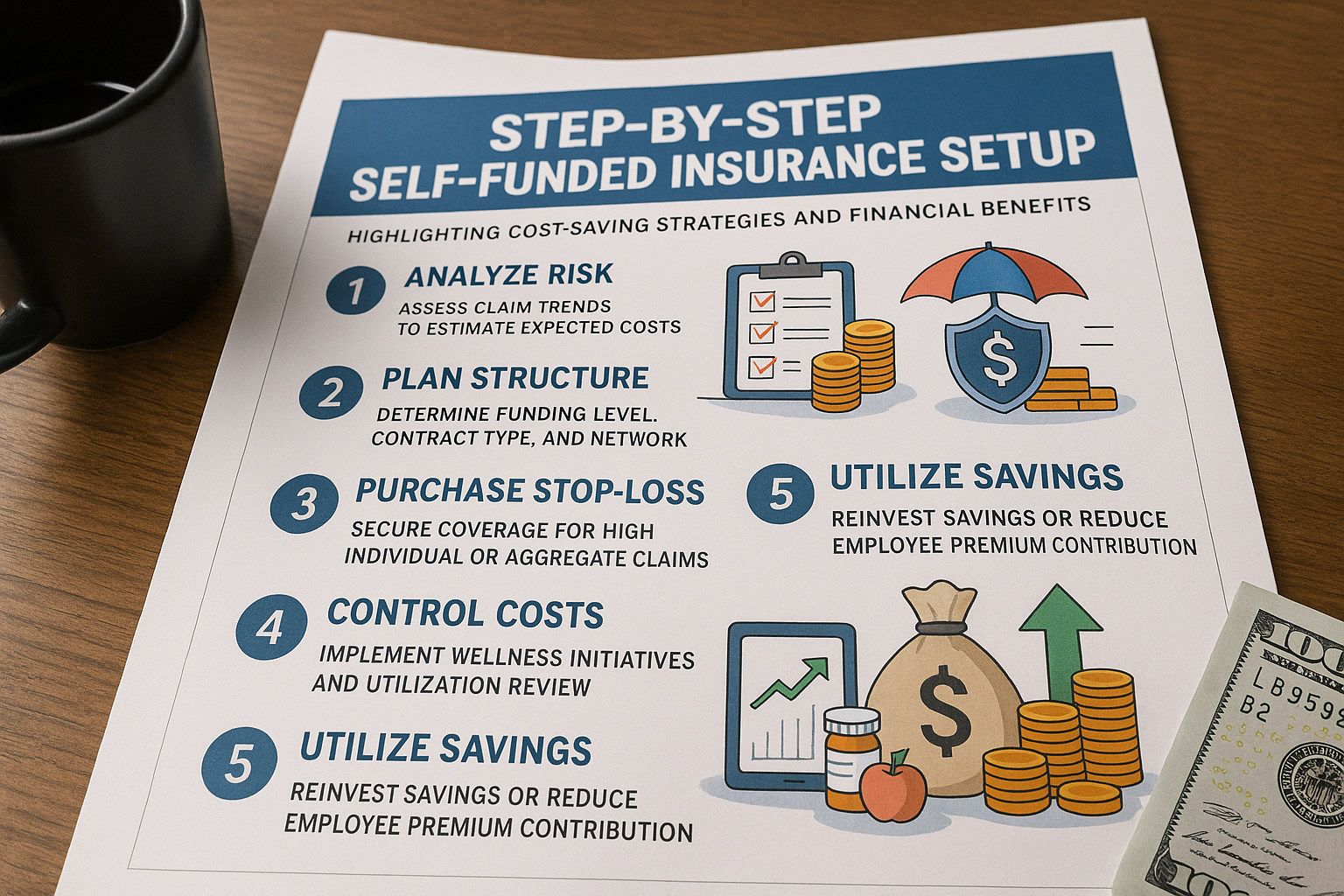

In a self-funded insurance plan, the employer assumes the financial risk for providing healthcare benefits to its employees. Instead of paying a fixed premium to an insurance carrier, the employer pays for actual claims incurred. To manage this risk, many companies purchase stop-loss insurance, which provides protection against large claims by capping the total amount the employer must pay.

Self-funded plans often involve a third-party administrator (TPA) to handle claims processing, provider networks, and other administrative tasks. This setup allows employers to maintain control over their plans while benefiting from the expertise of the TPA.

Financial Benefits of Self-Funded Insurance

One of the primary advantages of self-funded insurance is cost savings. By eliminating the profit margin that insurance companies add to their premiums, businesses can reduce their overall healthcare expenses. Additionally, self-funded plans offer more transparency, allowing employers to see exactly where their healthcare dollars are going and make data-driven decisions to optimize their benefits.

According to the Employee Benefit Research Institute, self-funded plans can save employers 10% to 25% on healthcare costs compared to fully insured plans1. These savings can be reinvested into the business or used to enhance employee benefits, creating a more attractive compensation package.

Flexibility and Customization

Self-funded insurance plans offer unparalleled flexibility, enabling employers to design benefits that align with their specific workforce needs. Employers can choose which services to cover, set their own deductibles and copayments, and even exclude certain benefits that may not be relevant to their employees. This level of customization ensures that employees receive the coverage they need without paying for unnecessary extras.

Moreover, self-funded plans can be adjusted annually based on the company's financial performance and employee needs, providing a dynamic approach to healthcare benefits.

Considerations and Challenges

While self-funded insurance offers many benefits, it also comes with certain challenges. Employers must be prepared to manage the financial risk associated with unpredictable healthcare claims. This risk can be mitigated by purchasing stop-loss insurance, but it still requires careful consideration and financial planning.

Additionally, self-funded plans may not be suitable for all businesses, particularly smaller companies with limited financial resources. It's crucial for employers to assess their risk tolerance and financial stability before transitioning to a self-funded model.

Exploring Your Options

If you're considering self-funded insurance, it's essential to explore the available options and consult with experts who can guide you through the process. Many specialized services offer tailored solutions for businesses of all sizes, helping them implement self-funded plans efficiently and effectively.

By visiting websites of third-party administrators and insurance consultants, you can gain insights into the best practices and strategies for managing a self-funded plan. These resources can provide valuable information on cost-saving measures, plan design, and compliance with regulatory requirements.

Self-funded insurance presents an opportunity for businesses to take control of their healthcare costs and tailor their benefits to meet the needs of their workforce. By understanding the mechanics and advantages of self-funded plans, employers can make informed decisions that lead to substantial savings and improved employee satisfaction. As you explore these options, you'll discover a range of solutions designed to optimize your insurance strategy and enhance your company's financial health.