Slash Processing Costs Instantly with These Merchant Account Rates

If you're tired of exorbitant fees eating into your profits, it's time to slash processing costs instantly by exploring new merchant account rates—browse options and discover how you can keep more of your hard-earned money.

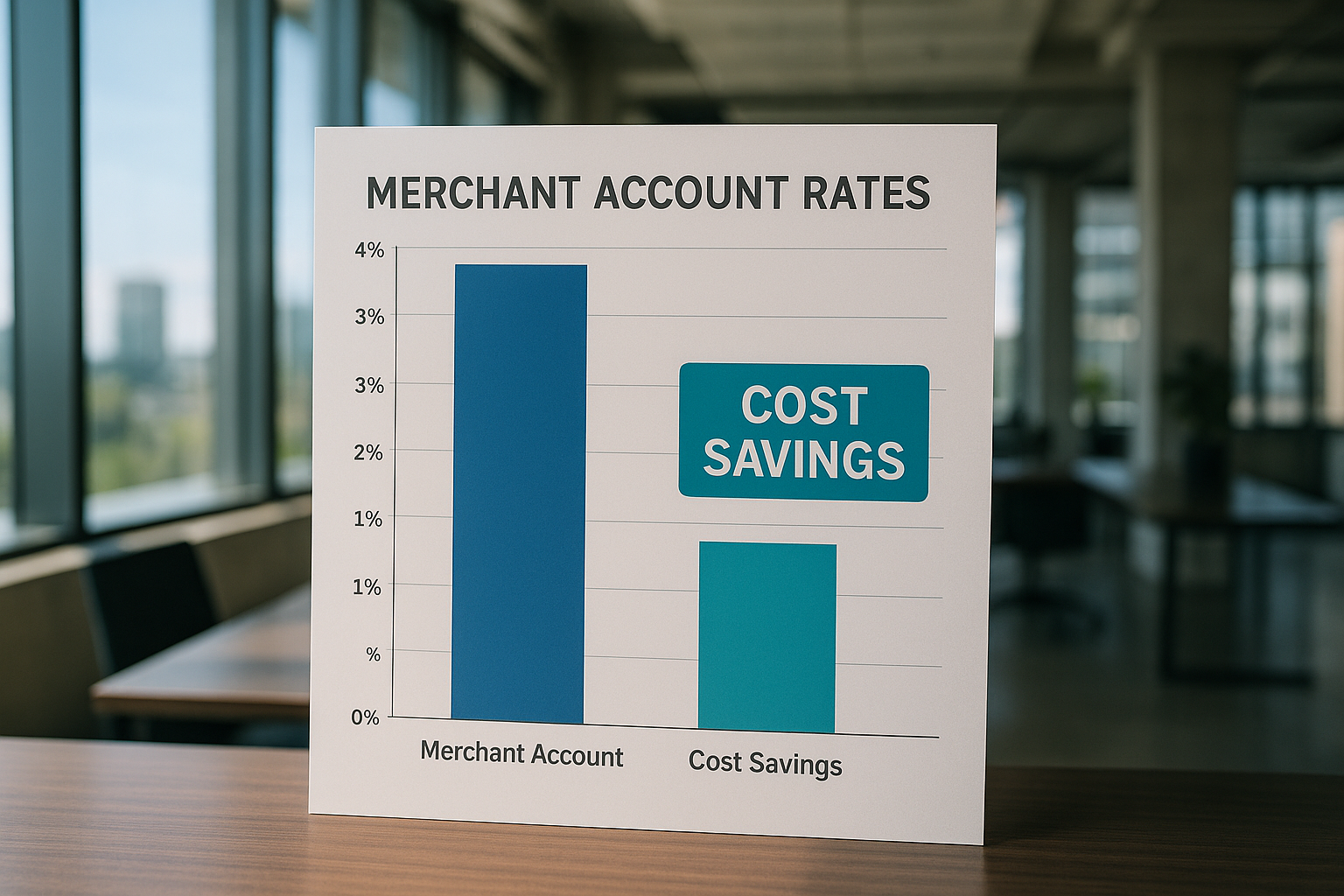

Understanding Merchant Account Rates

Merchant account rates can significantly impact your business's bottom line, yet many business owners overlook the potential savings they offer. These rates are the fees that merchants pay to process credit card transactions. Typically, they include a percentage of each transaction plus a fixed fee. By shopping around and comparing rates, businesses can find more competitive offers that reduce their overall costs.

The Breakdown of Merchant Account Fees

To fully grasp the potential savings, it's crucial to understand the different components of merchant account fees:

1. **Interchange Fees**: These are set by credit card networks like Visa and MasterCard and are non-negotiable. They typically range from 1.5% to 3.5% per transaction1.

2. **Assessment Fees**: Charged by the credit card associations, these fees are usually a small percentage of the transaction amount. For instance, Visa's assessment fee is around 0.13%2.

3. **Processor Markup**: This is the negotiable part of your fees, where the processor adds their profit margin. This is where you can find significant savings by comparing different providers.

Strategies to Reduce Processing Costs

Lowering your processing costs starts with understanding your current fees and then strategically negotiating better rates. Here are some actionable steps you can take:

- **Negotiate with Your Current Provider**: Often, simply asking for a better rate can lead to savings. Providers may offer lower rates to retain your business.

- **Shop Around**: Don't settle for the first offer you receive. Browse and compare multiple merchant account providers to find the most competitive rates.

- **Consider a Flat-Rate Processor**: Some processors offer flat-rate pricing, which can be beneficial for businesses with smaller transaction volumes, as it simplifies the fee structure.

- **Utilize Tiered Pricing**: For businesses with varying transaction types, tiered pricing can offer savings by categorizing transactions into different rate tiers.

Real-World Examples of Cost Savings

Many businesses have successfully reduced their processing costs by switching providers or renegotiating their rates. For instance, a small retail store reduced its fees by 25% by moving to a provider with a transparent pricing model3. Similarly, an online business saved thousands annually by opting for a processor with lower interchange-plus pricing.

Exploring Specialized Solutions

For businesses with unique needs, specialized solutions like high-risk merchant accounts or industry-specific processors can offer tailored rates and services. These options cater to businesses in sectors such as travel, subscription services, or e-commerce, where standard rates may not apply.

Taking Action

Reducing your merchant account fees is not just about saving money—it's about reinvesting in your business's growth. By understanding the components of these fees and actively seeking better rates, you can significantly improve your profit margins. As you explore your options, remember that the right provider can offer more than just savings; they can deliver a competitive edge through enhanced services and support.