Transform Distributor Profits with Ingenious Supply Chain Finance

Unlocking the potential of your distribution business through ingenious supply chain finance strategies can revolutionize your profit margins, and as you explore these options, you'll discover ways to optimize cash flow, reduce costs, and gain a competitive edge.

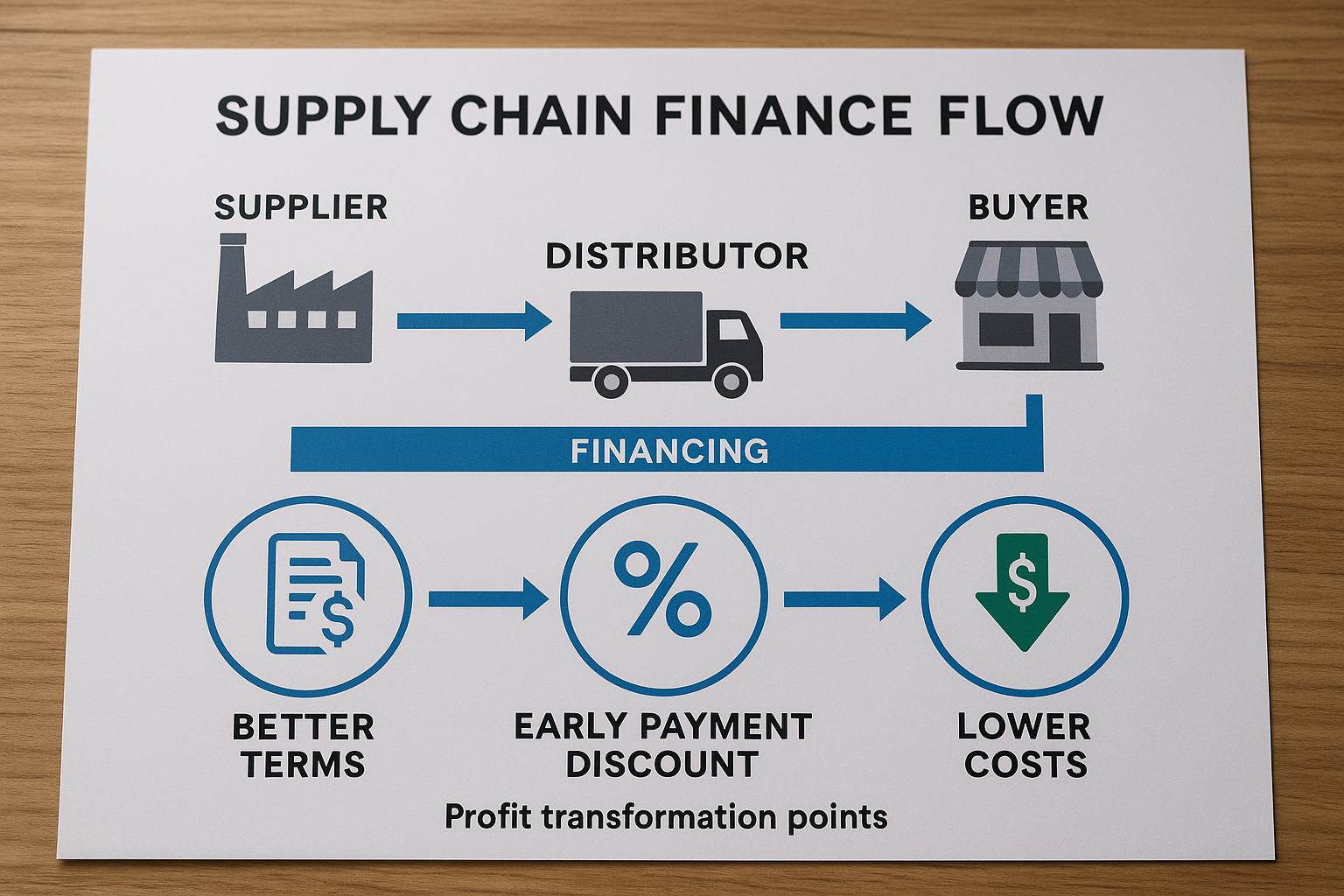

Understanding Supply Chain Finance

Supply Chain Finance (SCF) is a set of solutions that optimizes cash flow by allowing businesses to extend their payment terms to suppliers while enabling suppliers to get paid early. This financial strategy bridges the gap between buyers and suppliers, ensuring that both parties benefit from improved liquidity and operational efficiency. By implementing SCF, distributors can enhance their working capital management, reduce the cost of goods sold, and improve supplier relationships.

The Benefits of Supply Chain Finance for Distributors

The primary advantage of SCF is its ability to transform distributor profits by improving cash flow and reducing financial strain. With SCF, distributors can negotiate better terms with suppliers, which can lead to cost savings and increased profitability. Additionally, SCF solutions often come with lower interest rates compared to traditional financing options, making it a cost-effective choice for businesses looking to optimize their financial operations.

According to a report by McKinsey, companies that effectively implement SCF can reduce their cost of goods sold by up to 5%1. This reduction directly impacts the bottom line, making SCF an attractive option for distributors aiming to enhance their profit margins.

Real-World Applications and Examples

Several industry leaders have successfully integrated SCF into their operations. For instance, Procter & Gamble (P&G) has utilized SCF to improve its payment terms with suppliers, reducing its working capital requirements and enhancing its financial flexibility2. This approach not only strengthens supplier relationships but also provides P&G with a competitive advantage in the market.

Another example is Siemens, which has implemented SCF to streamline its supply chain processes and improve its cash flow. By leveraging SCF, Siemens has been able to reduce its days payable outstanding (DPO) and increase its operational efficiency3.

Implementing Supply Chain Finance in Your Business

To effectively implement SCF, distributors should start by assessing their current financial processes and identifying areas where SCF could provide the most benefit. This involves evaluating supplier relationships, payment terms, and cash flow management practices. Once these areas are identified, distributors can work with financial institutions or specialized SCF providers to develop a tailored solution that meets their specific needs.

It's crucial to choose the right SCF provider, as they play a significant role in the success of the implementation. Look for providers with a proven track record, robust technology platforms, and flexible financing options. As you browse options and explore various providers, consider their reputation, service offerings, and the level of support they provide throughout the implementation process.

Key Takeaways

Supply Chain Finance offers distributors a strategic advantage by optimizing cash flow, reducing costs, and enhancing supplier relationships. By implementing SCF, businesses can improve their financial health and gain a competitive edge in the market. As you search options and explore the potential of SCF, consider the real-world benefits and success stories of industry leaders who have transformed their operations through this innovative financial strategy.