Transform Windstorm Deductible Costs With This New Jersey Miracle

Transforming your windstorm deductible costs in New Jersey can unlock significant savings and peace of mind—explore these options to discover how you can benefit today.

Understanding Windstorm Deductibles

Windstorm deductibles are a specific type of insurance cost that policyholders in high-risk areas, such as New Jersey, often face. These deductibles apply to damages caused by wind-related events, including hurricanes and severe storms. Unlike standard deductibles, windstorm deductibles are typically calculated as a percentage of the insured value of the property, which can lead to substantial out-of-pocket expenses during a claim.

The New Jersey Advantage: Innovative Solutions

New Jersey homeowners have access to unique insurance options that can significantly reduce windstorm deductible expenses. By opting for policies that offer fixed dollar deductibles instead of percentage-based ones, you can achieve more predictable financial planning. Additionally, many insurance providers in the region now offer bundled policies that include windstorm coverage at competitive rates, further lowering your overall insurance costs. It's essential to browse options and find a policy tailored to your needs.

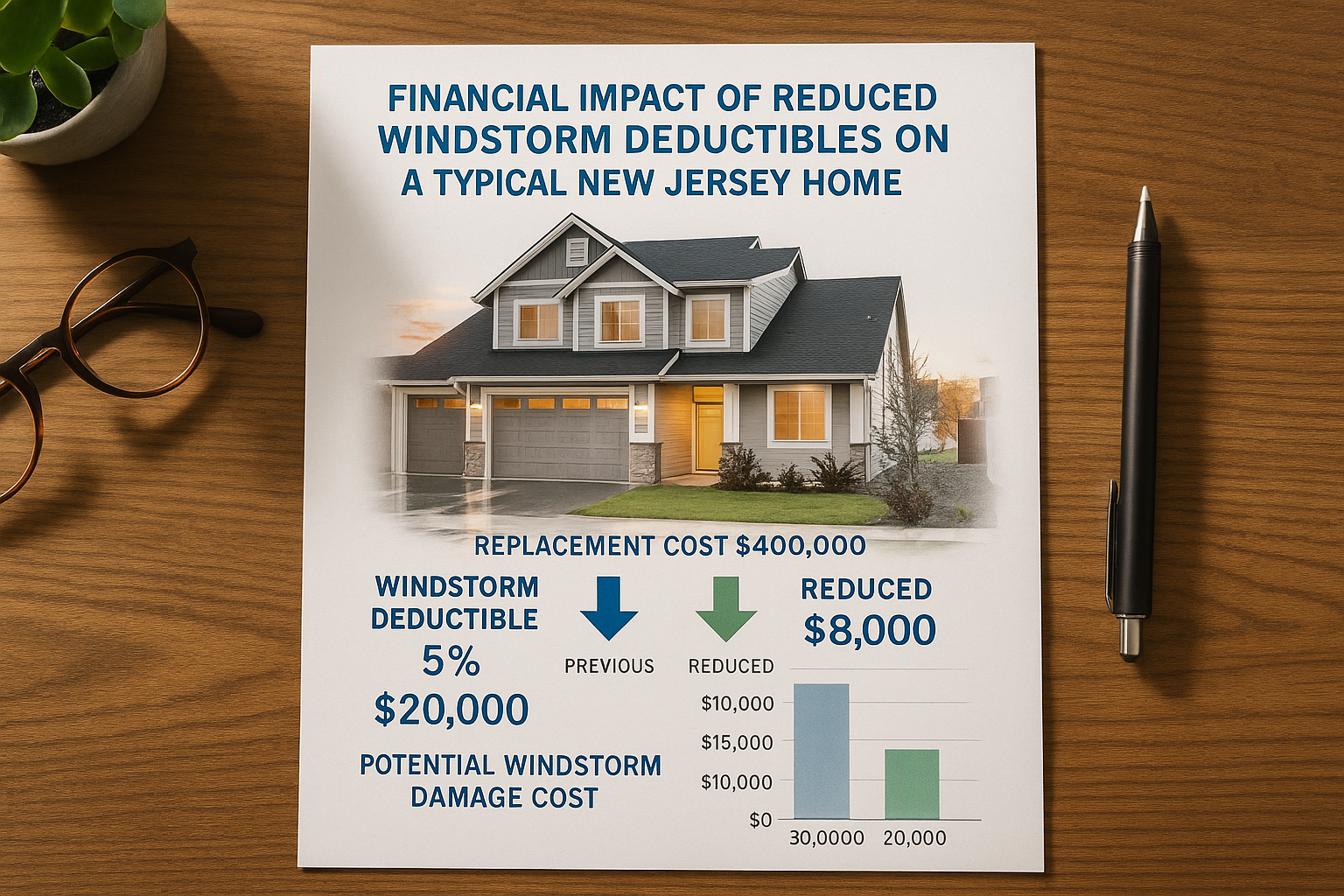

Financial Benefits and Cost Savings

Switching to a more favorable windstorm deductible plan can result in considerable savings. For instance, if your home is valued at $300,000 and your policy includes a 5% windstorm deductible, you would be responsible for $15,000 in the event of a claim. However, with a fixed deductible policy, this amount could be drastically reduced, offering you financial relief when it matters most. Many insurance companies are currently offering discounts or incentives for homeowners who upgrade their policies, making it a prime time to search options and see these opportunities.

Leveraging Specialized Services

To make the most of these opportunities, consider consulting with insurance brokers who specialize in windstorm coverage. These professionals can provide personalized advice and help you navigate the complex landscape of insurance options. By visiting websites and following the options available, you can find brokers who offer free consultations and policy reviews, ensuring you get the best deal possible.

Real-World Examples and Statistics

According to the Insurance Information Institute, New Jersey ranks among the top states for hurricane-related claims1. This statistic underscores the importance of having adequate windstorm coverage. Additionally, recent reports indicate that homeowners who switched to fixed deductible policies saved an average of 20% on their premiums2. These savings highlight the tangible benefits of exploring different policy options.

Exploring Further Resources

For homeowners looking to delve deeper into windstorm deductible solutions, there are numerous resources available online. Insurance company websites often provide detailed policy comparisons and calculators to estimate potential savings. By visiting these platforms, you can gain a clearer understanding of the options that best suit your financial situation and coverage needs.

By taking proactive steps to transform your windstorm deductible costs, you can secure significant financial benefits and peace of mind. With the right resources and expert guidance, navigating the complexities of windstorm insurance in New Jersey becomes a manageable and rewarding endeavor. Explore these options today to ensure your home and finances are well-protected.