Turn Assets Into Cash Instantly With This Secret Strategy

Unlock the potential of your assets and transform them into cash instantly by browsing options that reveal a secret strategy designed to maximize your financial flexibility and immediate liquidity.

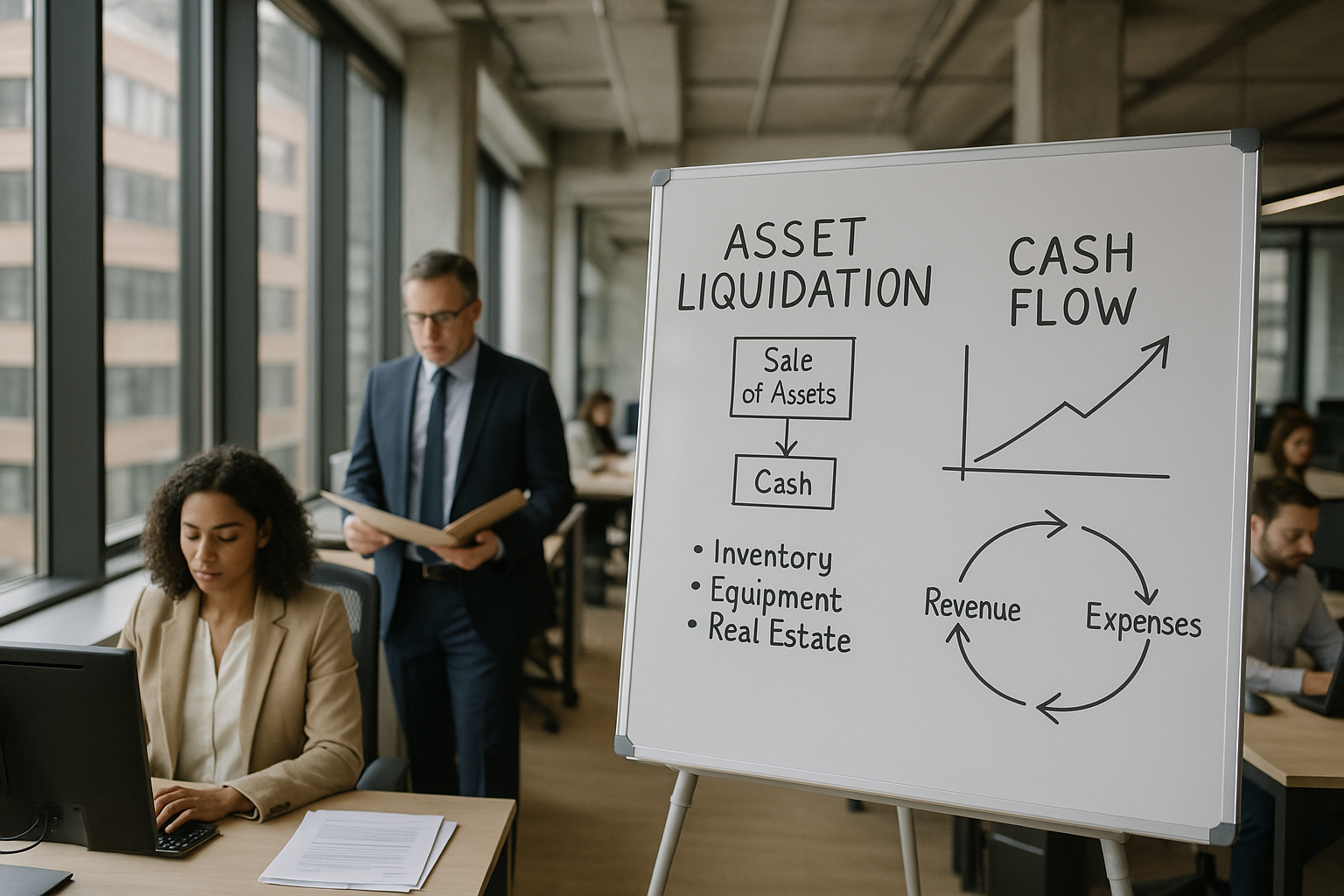

The Secret Strategy to Liquidate Assets

In today's fast-paced financial landscape, having immediate access to cash can be a game-changer. Whether you're looking to invest in a new business venture, cover unexpected expenses, or simply increase your liquidity, turning assets into cash quickly is a valuable skill. The secret strategy lies in leveraging a combination of asset-backed loans, selling underutilized assets, and exploring peer-to-peer lending platforms.

Asset-backed loans are a popular choice for those seeking quick cash. These loans are secured by collateral, such as real estate, vehicles, or even valuable collectibles. By using your assets as security, you can often secure a lower interest rate and faster approval process compared to unsecured loans1.

Maximizing Value with Asset Sales

Selling underutilized assets is another effective way to generate cash. This could include anything from selling old equipment that your business no longer needs to liquidating personal items that hold value. Online marketplaces and auction sites provide platforms to reach a wide audience, ensuring you get the best price for your assets. Websites like eBay and Craigslist are excellent starting points2.

Exploring Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending platforms offer an innovative way to access funds by borrowing from individuals rather than traditional financial institutions. These platforms match borrowers with lenders, often resulting in lower interest rates and more flexible terms. Popular P2P platforms such as LendingClub and Prosper have become increasingly popular for their efficiency and ease of use3.

Real-World Examples and Financial Insights

Consider the case of a small business owner who needed quick cash to capitalize on a sudden opportunity. By taking an asset-backed loan against his commercial property, he was able to secure the necessary funds within days, allowing him to invest in new inventory and expand his business. This strategic move not only provided immediate liquidity but also positioned his business for future growth.

According to recent data, the asset-backed lending market has grown significantly, with a reported $4.5 trillion in loans issued globally in 20224. This growth underscores the increasing reliance on asset-backed solutions as businesses and individuals seek more flexible financial options.

Cost Considerations and Potential Returns

While the benefits of turning assets into cash are clear, it's essential to consider the costs involved. Asset-backed loans may include appraisal fees, legal fees, and other administrative costs. However, these are often outweighed by the potential returns and the ability to seize timely opportunities.

Additionally, selling assets requires a strategic approach to ensure you receive fair market value. Researching market trends and consulting with valuation experts can help maximize your returns.

Exploring Further Opportunities

For those interested in delving deeper into these strategies, numerous resources are available online. Websites dedicated to financial planning and investment strategies offer detailed guides and tools to help you navigate the process. By visiting websites and following the options presented, you can uncover additional insights and opportunities tailored to your specific needs.

By understanding and implementing these strategies, you can quickly convert your assets into cash, providing you with the financial agility needed to thrive in today's dynamic economy.