Unveil Hidden Deals on Contractor Insurance Quotes Now

Unlock the potential to save on contractor insurance by discovering hidden deals and browsing options that could significantly reduce your business costs today.

Understanding Contractor Insurance: A Key Business Asset

Contractor insurance is an essential safeguard for any business in the construction industry, offering protection against a variety of risks that contractors face on a daily basis. This type of insurance typically includes general liability, workers' compensation, and sometimes professional liability, ensuring that businesses are covered in the event of accidents, property damage, or legal claims. As a contractor, securing the right insurance not only protects your assets but also enhances your credibility and trustworthiness with clients.

The Importance of Finding Hidden Deals

With the rising costs of operating a business, finding affordable contractor insurance can be a game-changer. Many contractors are unaware of the potential savings they can achieve by actively searching for hidden deals and discounts. By taking the time to explore various insurance providers, you can uncover special promotions or bundled packages that significantly lower your premiums. For example, some insurers offer discounts for contractors who have a proven track record of safety or those who bundle multiple types of coverage under one policy1.

How to Navigate the Contractor Insurance Market

Navigating the contractor insurance market can be overwhelming, but with the right approach, you can streamline the process and secure the best deals:

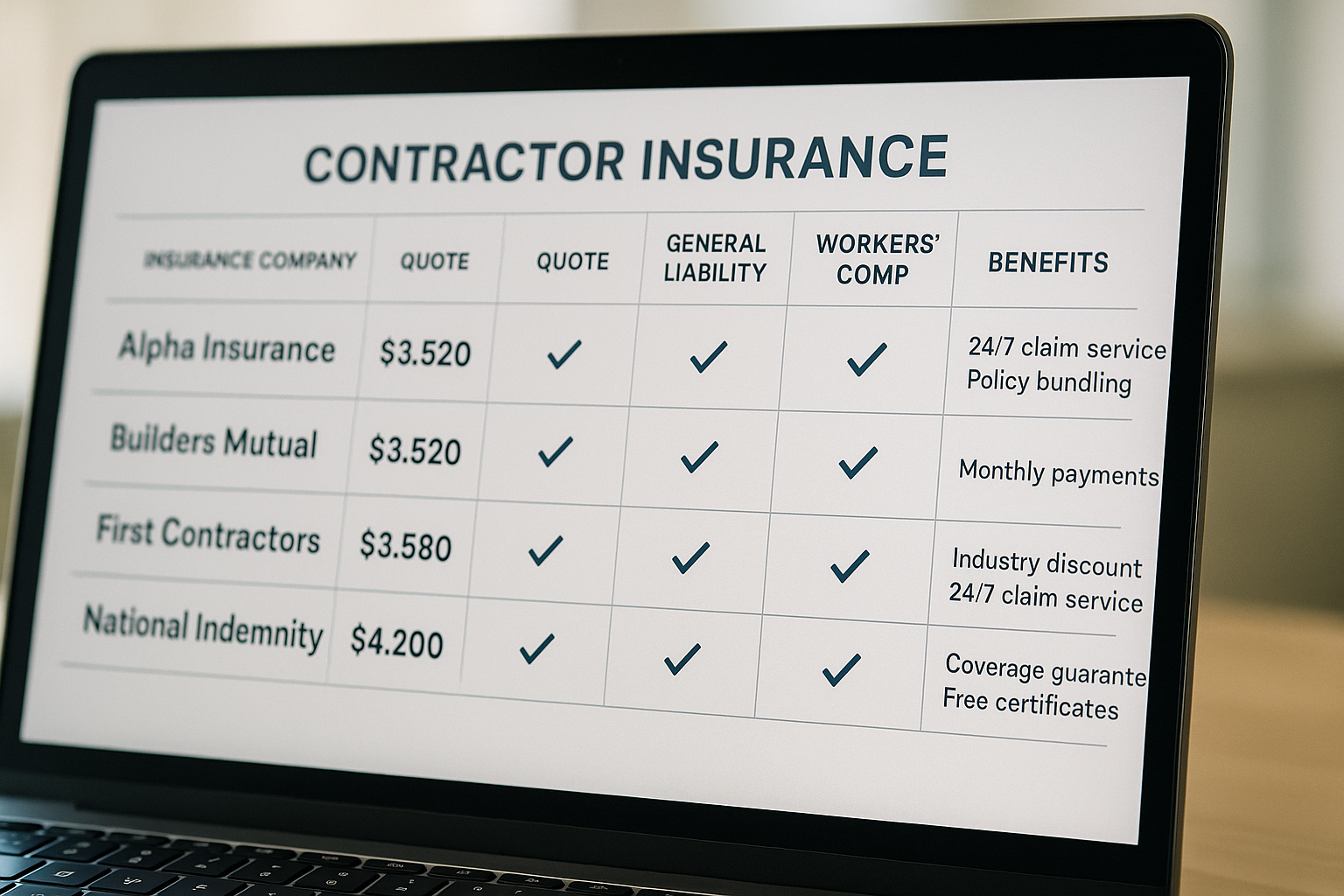

- Compare Multiple Quotes: Start by gathering quotes from various insurance providers. This allows you to compare rates and coverage options, ensuring you get the best value for your money.

- Leverage Online Tools: Utilize online comparison tools to easily browse options and identify competitive rates. These tools often highlight special deals that might not be immediately visible on individual insurer websites.

- Consult with an Insurance Broker: An experienced broker can provide insight into the best policies for your specific needs and may have access to exclusive deals not available to the general public2.

- Review Your Coverage Annually: Insurance needs can change as your business grows. Regularly reviewing your policy ensures you maintain adequate coverage while taking advantage of any new discounts or offers available.

Real-World Savings and Offers

It's not uncommon for insurance providers to offer discounts for various reasons. For instance, some companies provide a discount for contractors who implement workplace safety programs, reducing the likelihood of accidents and claims3. Additionally, loyalty discounts for long-term clients or multi-policy discounts for bundling different types of insurance can lead to significant savings.

Maximizing Your Insurance Investment

To truly maximize your investment in contractor insurance, it's crucial to stay informed about market trends and continuously seek out the best deals. By actively engaging in the insurance market, you not only protect your business but also ensure financial efficiency. Remember, the right insurance coverage is an investment in your business's stability and future growth.

By understanding the intricacies of contractor insurance and taking proactive steps to uncover hidden deals, you can secure comprehensive coverage at a cost-effective rate. As you browse options and explore the market, remember that the right insurance can provide peace of mind and financial security, allowing you to focus on growing your business.